A national vision and deeptech focus: ideas to scale Dutch tech

The Netherlands should focus on scaling companies in key technology areas where it still has a competitive edge, experts argue.

Published on December 9, 2025

.png&w=2048&q=75)

Mauro swapped Sardinia for Eindhoven and has been an IO+ editor for 3 years. As a GREEN+ expert, he covers the energy transition with data-driven stories.

The inability to scale startups has often emerged in the previous installments of Why We Fail. To the CEOs of InnovationQuarter, Lars Crama, and Golden Egg Check, Thomas Mensink: addressing this problem should be the priority. “We don’t lack startups," says Crama. "We lack companies that can scale."

InnovationQuarter is the economic development agency for the Province of Zuid-Holland, also known as the greater Rotterdam – The Hague area. The agency supports companies that want to expand in a region, but, most importantly, has four investment funds to support startups, scaleups, and innovation at different levels.

Golden Egg Check is a startup analyst and a pre-seed venture capital (VC) firm. Every quarter, in collaboration with the Dutch Startup Association, the firm publishes the Quarterly Startup Report, highlighting funding trends.

In this episode of Why We Fail, we spoke with them about their views on the current situation and ideas to improve it.

Why we fail - the struggles of the Dutch startup ecosystem

TechLeap’s State of Dutch Tech 2025 reveals a split: more scaleups, but fewer new startups secured €100K+ funding. In this series, we discuss the current status of the Dutch startup ecosystem and look for ways to improve it.

Capital flows

In the second quarter of 2025, investment levels reached €747 million, a considerable increase compared to previous periods. Such an uptick was justified by funds nearing the end of their investment periods. Yet in the following quarter, both late-stage and pre-seed investment declined. In this period, only 79 deals were completed, the lowest level since 2020.

Access to capital remains a critical bottleneck. Mensink highlights a binary fundraising environment: startups either secure funding quickly or struggle for months. "Investors prioritize companies with traction and social proof," he explains. "If you’re not in the ‘inner circle,’ fundraising becomes a long, lonely process."

Crama advocates for blended finance models—combining public and private capital—to support high-risk, deeptech startups. "We need to align all stakeholders—private investors, pension funds, and public funds—to create a seamless funding pipeline," he says.

Strengthening collaboration among actors

In this regard, Mensink also emphasizes the need for better collaboration among universities, corporations, and investors. "If we align these stakeholders, we can turn research into scalable businesses," he says.

And this sense of collaboration spans the national borders. Crama underlines how, to keep not only the Dutch but the European setting competitive, Dutch startups should collaborate with other clusters across Europe. In this way, strengths could be valorized, and local value chains in critical domains such as battery technology, medtech, and quantum computing could be reinforced.

Focusing on what matters most

InnovationQuarter’s CEO emphasizes the need for a national strategy on startups and scale-ups, with clear policies to drive innovation. "We need to double down on the data—where companies are, how they grow, and what they need," he says. "This will help us align incentives and reduce fragmentation." In other words, he suggests rationalizing the operability of the hundreds of ecosystem organizations.

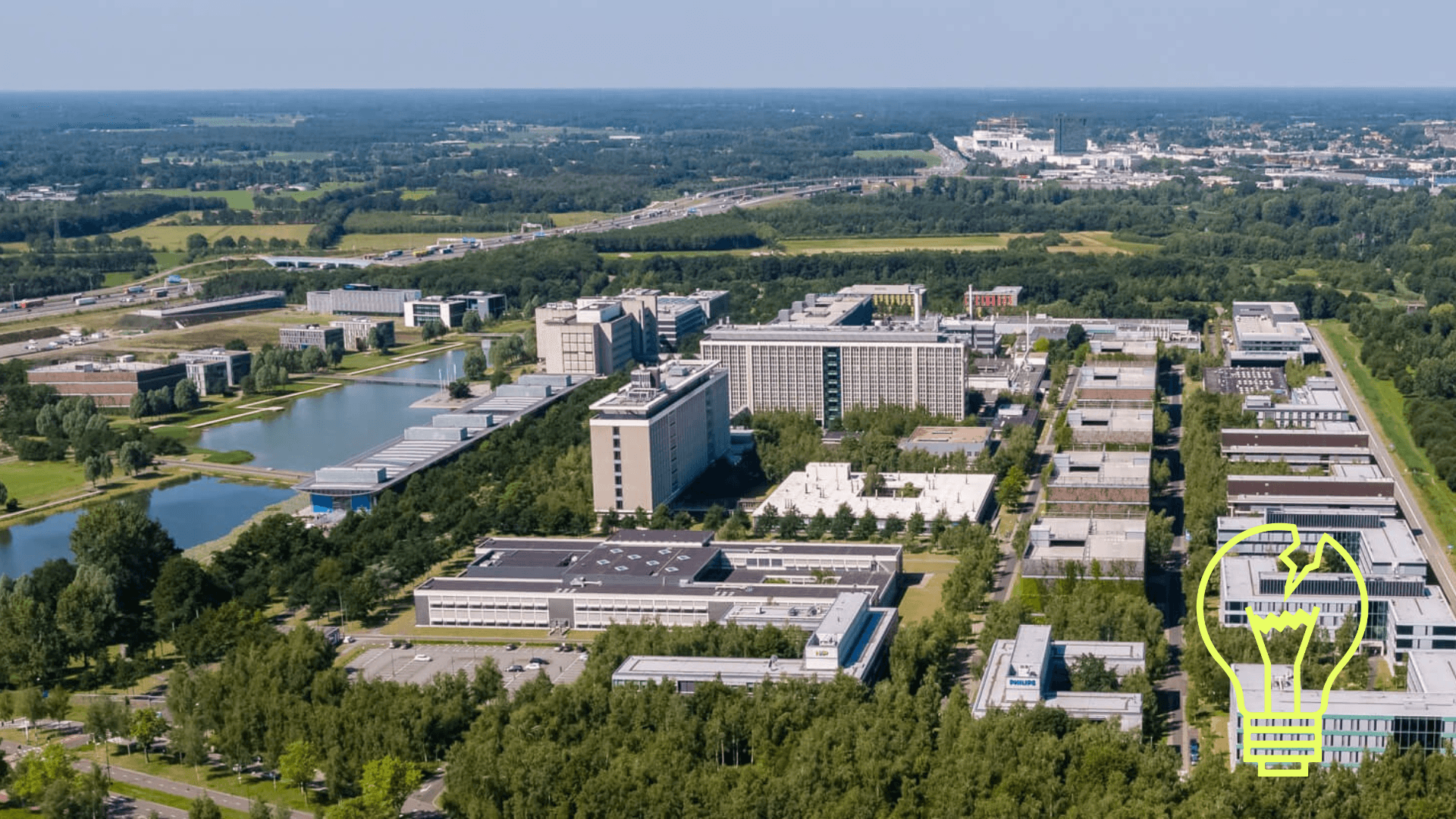

In addition, he highlights that the future of innovation depends on strengthening value chains through key enabling technologies. To this end, the focus should be on the areas where the Netherlands has “a right to play and a chance to win,” leveraging regional strengths and connecting them into integrated national and international value chains. An example is battery technology, where component manufacturers in Eindhoven, Delft, and Rotterdam collaborate within a broader European network.

Mensink believes the Netherlands should focus on deeptech ventures—companies developing cutting-edge technology based on breakthrough science and engineering—where it has a competitive edge. "We’re good at research, but we struggle to commercialize it," he says. "Universities should be more founder-friendly, and corporates should act as early adopters to support startups."

On top of that, he proposes a flywheel effect to sustain innovation: "If employees benefit from startup success, they become founders or angel investors, creating a cycle of growth." He also advocates tax incentives to encourage angel investing, which is currently lagging behind countries such as the UK.

Optimism for the future

Crama calls himself a ‘serious optimist’ and hopes for a systemic change by the end of the decade. "By 2030, I think the Netherlands has the potential to be the home to many new global deeptech champions, the backbone of our future economy and strategic autonomy," he says. “But that will only happen if we increase our ambition: to create new market leaders, not just startups.”

Mensink, while predicting a "little dip" in funding next year, is "quite optimistic about the future", believing the ecosystem will continue to mature.