Dutch startup funding soars to €747 million in Q2

Dutch startup funding saw a significant surge in the second quarter of 2025, topping €747 million.

Published on July 11, 2025

© Golden Egg Check

Team IO+ selects and features the most important news stories on innovation and technology, carefully curated by our editors.

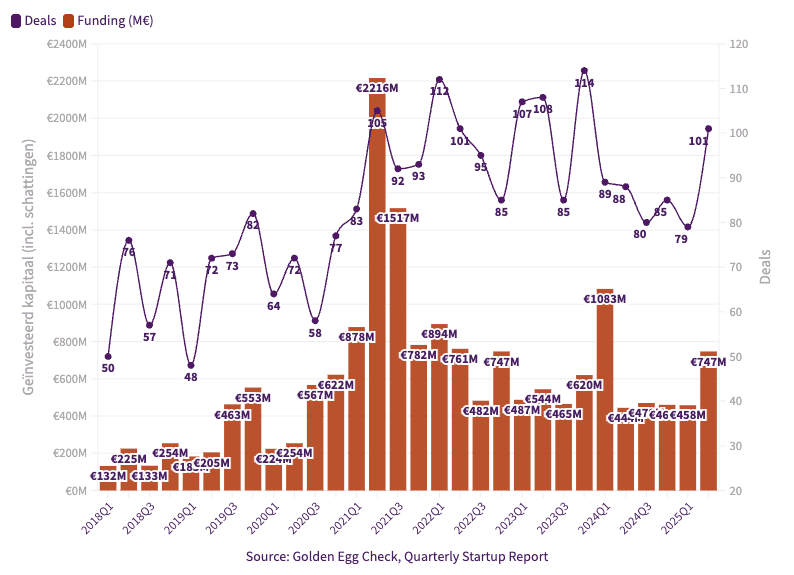

In the second quarter of 2025, funding for Dutch startups soared, with estimated investments reaching €747 million, according to the Quarterly Startup Report by Golden Egg Check. This leap is attributed to heightened interest in later-stage tech companies and a notable recovery in pre-seed investments, which had previously been in decline.

The second quarter of 2025 saw a dramatic 68% increase in startup funding compared to the same period in 2024, growing from €444 million to an estimated €747 million. The significant growth can be attributed to an emerging phase in the market where tech companies have once again proven their ability to secure substantial capital, possibly driven by funds nearing the end of their investment periods and re-engagement from entrepreneurs seeking to bolster sustainable growth models.

Active investment landscape

The quarter was marked by 101 investments, making it the joint eighth most active quarter on record, surpassing the 79 investments noted in Q1 2025 and the 88 investments of Q2 2024. This uptick in activity highlights a reinvigorated interest in the Dutch startup ecosystem, especially in late-stage funding rounds. Series B+ rounds, representing investments over €15 million, notably increased from 7 in Q1 to 12 in Q2 2025—an 81% surge in total invested amount.

The biotech and fintech sectors saw significant inflows, with Azafaros leading the charge through a €147 million funding round, followed closely by fintech company FINOM, which secured €115 million. These substantial investments underscore a broader trend towards larger financing rounds in these sectors, highlighting the continued appeal of medtech and software enterprises alongside a strong presence of deeptech investments.

Pre-seed investments, defined as those under €1 million, increased by 67%, rising from 12 in Q1 to 20 in Q2 2025. This resurgence addresses previous concerns about a shrinking pool of initial-stage ventures, which could have jeopardized the future supply of global players and scaleups. This revival signals renewed confidence in the early-stage investment landscape, fostering a healthier pipeline for future innovation.

Uncertainty for the future

“We see two positive exceptions taking place simultaneously that we don't see every quarter: a few very grand rounds and an increase in the number of deals, in the early and late phases. “, says Lucien Burm, chairman of the Dutch Startup Association. “It may be that there is a little more confidence and capital starts to move again, but do two swallows make a summer? It would be a big step. At the same time, it is still far from sufficient in the global competitive field.”.

“An interesting new phase seems to be entering this market, in which tech companies are once again able to attract larger investments”, says Thomas Mensink, CEO of Golden Egg Check. “This may have to do with a combination of, on the one hand, funds that come to the end of their investment period and have made relatively few deals in recent years, and on the other hand, more entrepreneurs who, after a previous investment, with or without additional financing, can now demonstrate that they have been able to survive and find a sustainable growth model and now choose to raise money again."

The top 10 funding rounds:

- Azafaros – $147 million

- FINOM – €115 million

- Salvia BioElectronics – €60 million

- Avidicure – €50 million

- Tebi – €30 million

- Gradyent – €28 million

- Iwell – €27 million

- AMT Medical – €22 million

- EFFECT Photonics – €24 million

- AppSignal – $22 million