Number of startup investments at 79, lowest level in years

Growth in late-stage, pre-seed investments decline in the third quarter. There was one mega-investment: Framer raised €100 million.

Published on October 14, 2025

LeydenJar at Strijp-T

Team IO+ selects and features the most important news stories on innovation and technology, carefully curated by our editors.

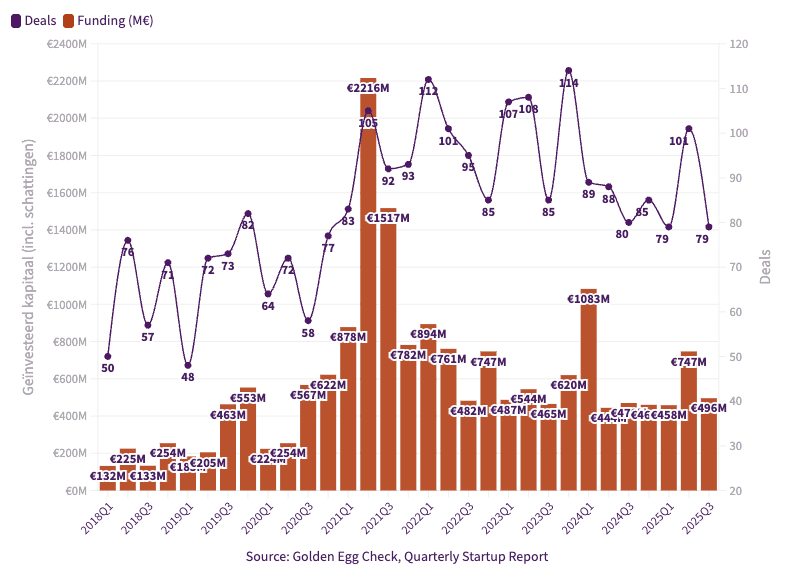

In the third quarter of 2025, approximately €464 million was invested in Dutch startups. This is an increase of 7% compared to the same quarter a year earlier (€434 million), but a decrease of 35% compared to the second quarter of this year (€716 million). This is according to the latest edition of the Quarterly Startup Report, a quarterly data analysis by Golden Egg Check, Dealroom.co, KPMG, the Regional Development Companies (ROMs), the Dutch Association of Private Equity Firms (NVP), Invest-NL, Techleap, led by the Dutch Startup Association (dSa).

A total of 79 investments were counted in the past quarter. That is 22% less than in the previous quarter (when there were 101 deals) and 1% less than a year ago (80 deals). This is the lowest number of deals since the third quarter of 2020.

After the upturn in the previous quarter, the number of pre-seed investments (under €1 million) fell again: from 20 to 12. The total amount of pre-seed investments also declined, from €5.3 million last year to €4.2 million now.

Seed investments (between €1 million and €4 million) remained the most common category, accounting for 42% of all deals. However, these represent only 9.7% of the total amount invested.

“Growth in later stages and certain technologies is not only a success factor, but also a cause for concern,” says Lucien Burm, chairman of the Dutch Startup Association. “The Netherlands and Europe do not have a strong and broad early-stage foundation like the US has built up in recent years and are falling further and further behind. Investments in critical technology and the growth phase are important, but if we ignore the foundation, we are undermining our ecosystem. Government incentives should therefore be broadened to cover all phases and be technology-agnostic, moving beyond the focus on deep tech and scaleups alone.”

Framer new unicorn

Series B+ investments (rounds of €15 million or more) decreased from 12 in the second quarter to 10 in the third. Nevertheless, their relative share grew again: this category now represents 68.5% of the total capital invested this quarter.

The increase in the share of late-stage deals (relative to all deals) has continued steadily this year: from 12.7% in Q1 to 15.2% in Q2, and now 16.1%.

The third quarter saw one mega-investment: Framer raised a Series D round of $100 million from Meritech and Atomico. This round values the Amsterdam-based company at $2 billion, making it the newest Dutch unicorn. “As the Netherlands, we can be proud of our new unicorn Framer,” says Myrthe Hooijman of Techleap. “But the number of early-stage investments is at its lowest point in five years. If we want more Framers to follow, strategic choices must be made now. Entice talent and business angels to invest in the Netherlands with competitive tax regulations, keep proven effective regulations in place, and implement consistent policies. That is also my call for the upcoming elections.”

Q3 2025 © Dutch Startup Association

Top 10 largest investments in the third quarter of 2025

- Framer $100,000,000

- ViCentra (Kaleido) $85,000,000

- The Protein Brewery €30,000,000

- Revyve €24,000,000

- Dexter Energy €23,000,000

- Sympower €19,000,000

- Insify €16,300,000

- QuiX Quantum €15,000,000

- LeydenJar €13,000,000

- DeftPower €12,500,000

Sector trends: strong growth in food and cleantech

The foodtech sector showed a striking increase with seven deals worth approximately €60 million, compared to the usual two to three deals per quarter. Cleantech and hightech also continued to perform well: hightech amounted to approximately €70 million.

Of all investments, nearly one-third went to startups where AI is at the core of the product. No investments in fundamental AI were reported. As expected, the vast majority, namely two-thirds, apply AI.

Major role for government funds

Noteworthy is the prominent role of public funds such as Invest-NL, which was involved in more than half of the 10 largest deals in the third quarter, including Vicentra (Kaleido), The Protein Brewery, Revyve, LeydenJar, and QuiX Quantum. “Although I am proud that Invest-NL was involved in six of the ten most important investment rounds last quarter, the overall picture is not positive,” says Rinke Zonneveld, CEO of Invest NL. "The limited number of early-stage deals is particularly worrying. After all, the scale-ups of tomorrow are today's early-stage startups. We must all ensure that this pipeline remains well-filled with promising ventures."