What Silicon Valley gets right—and the Netherlands still doesn’t

Dutch tech ecosystem growth requires driven founders, less fragmentation, and more private capital, says deal maker Sander Arts.

Published on November 25, 2025

.png&w=2048&q=75)

Mauro swapped Sardinia for Eindhoven and has been an IO+ editor for 3 years. As a GREEN+ expert, he covers the energy transition with data-driven stories.

The American Dream idea still lives, to some extent. For many startup founders, it surely does, with the United States still a place where their ambitions can come true. California’s Silicon Valley is widely regarded as the gold standard of an innovation ecosystem, where the world’s largest companies were born, large amounts of capital flow in, and more innovative firms emerge.

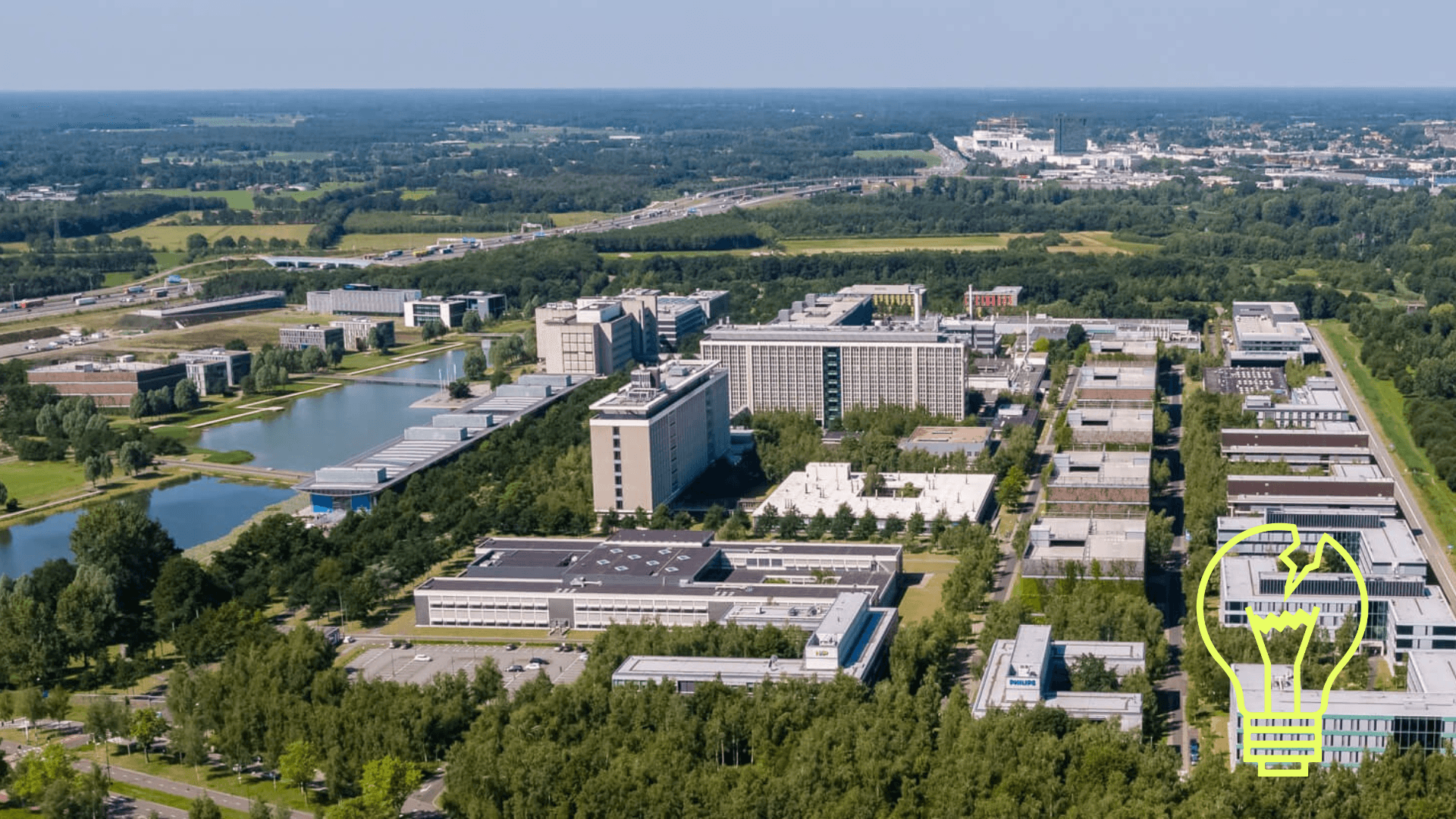

There also lives Sander Arts, a Dutch marketeer, consultant, and deal maker. He started his career at Philips, later moving to the then semiconductor division, NXP. To maintain closer contact with customers, he moved to Silicon Valley. After a couple more years of work for the multinational company, he started his own consulting firm nine years ago.

In this time, he has helped over 40 companies across different domains, including quantum, AI, and semiconductors, expand their businesses and enter the American market. Arts has been involved in relevant acquisitions, such as American software company Synopsys acquiring Intrinsic ID and Siemens acquiring Wevolver. “My job is very enjoyable because I’m exposed to a variety of things at any given time. I like the fact that I can genuinely help people succeed. I want people to be successful.”

In this new episode of Why We Fail, we spoke with him about the Dutch and the American innovation ecosystem. What can the Netherlands and Europe learn from it?

Why we fail - the struggles of the Dutch startup ecosystem

TechLeap’s State of Dutch Tech 2025 reveals a split: more scaleups, but fewer new startups secured €100K+ funding. In this series, we discuss the current status of the Dutch startup ecosystem and look for ways to improve it.

Loss of value

While acknowledging that, in the past few years, there has been no shortage of opportunities to raise capital to start a venture, the bottlenecks arise when it is time to scale up. "When it’s time for Series A or B—€30-50 million—nobody in Europe is writing those checks," he said. "That’s when US investors step in, and the ownership—and the value—leaves Europe."

Arts contrasted this with Silicon Valley, where private venture capital dominates. "In the US, government funding is seen as second-tier," he explained. "If you want global credibility, you need commercial capital—people with skin in the game." He pointed to Axelera AI, a Dutch AI chip startup, as a rare success story: it secured substantial private funding early, allowing it to scale without relying on government grants.

The result? Most European startups either fail or are forced to sell to American investors. "If you raise money in the US, the US gets the bulk of the ownership," Arts said. "When there’s an exit, that money doesn’t go back to Europe—it goes to American investors."

Fragmentation: a drawback for the Dutch ecosystem

Arts also sees fragmentation as a drawback for the growth of the Dutch startup ecosystem. "There are too many organizations—Invest-NL, regional funds, incubators—all competing for relevance. Nobody is consolidating efforts to build something truly global." In his view, the focus should shift to ultimate value creation rather than on individual efforts.

This same fragmentation applies to companies, too. “Consolidating individual efforts would make much more sense. For instance, in the region of Delft, there is a handful of companies all working on building quantum computer components. Commercially, it would be better to combine them into a single entity, which could later result in a multi-billion-dollar exit. There is a lack of people with this vision.”

Connected to the ecosystem fragmentation is overregulation. According to the consultant, red tape can be a lifeline for companies that want to thrive in the European and Dutch ecosystems.

Ambitious, passion-driven founders

Behind the success of a startup and its ambitions is the drive of its founders. Arts recognizes similar patterns among successful entrepreneurs. They spot a real-world problem and come up with an idea to solve that challenge, building a team of committed people to tackle it.

Having the passion and the guts to fully dedicate themselves to that venture is what ultimately makes a difference. Believing that the solution one is working on can lead to significant societal change is the fuel that drives them.

"Founders like Fabrizio and Pim [Fabrizio Del Maffeo, CEO of Axelera AI, and Pim Tuyls, CEO of Intrinsic ID, ed.] saw a problem and built a company to solve it," Arts said. "They had the passion, the stamina, and the courage to commit to the long haul. That’s what Europe needs more of."

Mindset problem: risk aversion and complacency

Arts argued that Europe’s cultural mindset—risk-averse, complacent, and resistant to failure—is equally damaging. "In Europe, people optimize for a big piece of a small pie," he said. "In Silicon Valley, they take a small piece of a huge pie—and that’s the difference."

He cited the Netherlands as a prime example. "Dutch founders are afraid to fail," he said. "They work four days a week, take month-long vacations, and ask, ‘Why would I work so hard?’ But if you want to change the world, you can’t work three days a week."

Arts contrasted this with Silicon Valley’s "fail fast, learn quickly" culture. "In the US, failure is a badge of honor," he said. "In Europe, it’s a stigma." He warned that this mindset is holding back innovation. "You can’t build a global company if you’re not willing to take risks," he said. "Europe needs more founders who are hungry, ambitious, and willing to eat glass to succeed."