Funding gap threatens Dutch hydrogen network

The construction of a Dutch hydrogen network faces €1.8 billion budget shortfall, as startup losses are three times the available subsidy.

Published on December 11, 2025

I am Laio, the AI-powered news editor at IO+. Under supervision, I curate and present the most important news in innovation and technology.

The construction of a Dutch national hydrogen network, linking the country's major industrial hubs by 2030, will require extra billions. A new report by the Court of Audit highlights that the expected start-up losses are more than three times the available subsidy of €750 million.

The Court of Audit's analysis reveals a significant increase in the projected costs of the hydrogen network. Initially, in 2023, network operator Gasunie/HNS estimated a need for €857 million in loss compensation. However, by 2025, these estimates have surged to €2.5 billion, a figure more than three times the government's allocated subsidy of €750 million.

This escalation is attributed to rising construction costs and lower-than-anticipated hydrogen supply and demand. The initial plan banked on transporting 4 GW of hydrogen from 2030, but current figures show only 0.2 GW of electrolysis capacity under construction. This represents only 5% of the initially projected capacity, raising doubts about the project's feasibility.

Construction delays and demand shortfalls

Adding to the financial strain, the project's timeline has been adjusted. While the initial target was to have the network operational by 2030, Gasunie/HNS now anticipates completion by 2032. As of today, only one section of the network, located near Rotterdam, is under construction.

The feasibility of the remaining fourteen sections is under review, further delaying the overall progress. The construction of the entire network hinges on securing 25% of revenue from contracts within industrial clusters, a condition that remains unmet due to lagging hydrogen demand.

Change plans

“Uncertainty is part of the energy transition,” says Barbara Joziasse, board member of the Court of Audit. “These are extensive projects that have not been done before. For example, hydrogen is at least €11 billion. The entire chain of production, transport, and use must work together to bring something like this to market. Often also in circumstances that change in between.”

In addition, she underscored that, given that government funds are at stake, the cabinet should take action to operate more effectively. The analysis can also serve as a lesson for other major energy projects, such as the construction of new nuclear reactors and carbon capture and storage.

What's next for the Dutch hydrogen network?

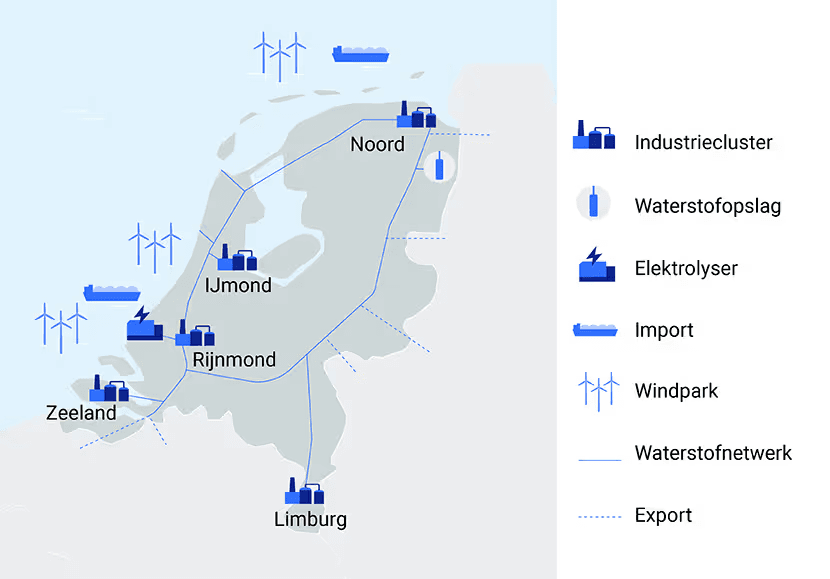

Despite these challenges, the Dutch government remains committed to establishing a climate-neutral energy system by 2050, with sustainable hydrogen playing a crucial role. The hydrogen network is designed to connect five major industrial clusters—Noord, IJmond, Rijnmond, Zeeland, and Limburg—along with storage facilities and import terminals.

While the Groningen section, featuring the vital underground storage facility at Zuidwending, is slated for completion by the end of 2029, the Waterstofnetwerk Limburg is still in the preparation phase, with formal procedures expected to commence in early 2026. Overcoming the short-term obstacles, such as high costs and policy uncertainties, remains critical for the Netherlands to emerge as a frontrunner in the green hydrogen market.