Wind energy race: can Europe catch up?

European wind power installations are not going fast enough, with the risk of not meeting EU climate targets. Yet, the outlook is positive.

Published on January 27, 2025

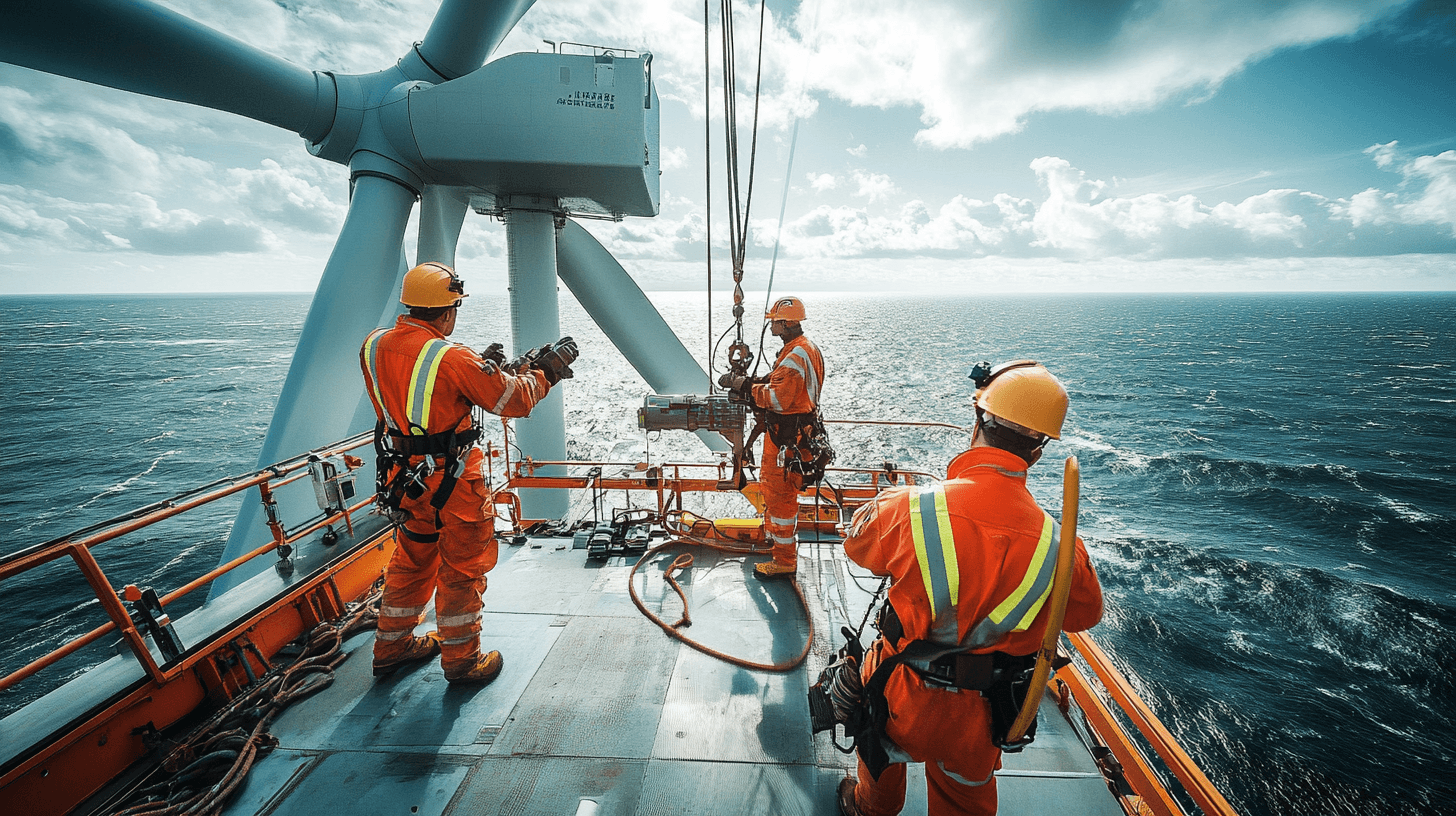

AI-generated image

Mauro swapped Sardinia for Eindhoven and has been an IO+ editor for 3 years. As a GREEN+ expert, he covers the energy transition with data-driven stories.

The Dutch and European energy systems are decarbonizing, yet wind power is at risk of missing its 2030 targets. Earlier this month, industry group Wind Europe sounded the alarm, as the EU only built 13GW of new capacity. This addition is much lower than needed to meet its 2030 energy targets, requiring 30GW of new installations annually.

In the past few years, solar and wind power growth has accelerated the phase-out of coal and oil. According to energy think tank Ember’s newly published European Electricity Review 2025, wind is now the second source of electricity in Europe after nuclear, contributing 17% of the total generation–and having surpassed gas.

Yet, things are not moving fast enough. Wind Europe points to three problems: national governments not applying EU permitting rules, the delay of new grid connections, and the slow pace of electrification slowing down demand. Chris Rosslowe, senior analyst at Ember, agrees with this analysis. “These barriers are indeed slowing down wind energy developments, with electrification being a broader problem for all climate ambitions,” he adds.

Wind power permitting procedures

Since the European Green Deal launch—the EU’s master plan to reach climate neutrality by 2050–many policies have been launched on the EU level to stimulate wind power. Measures like the REPowerEU plan use principles like the overriding public interest rule to speed up procedures. 2023’s European Wind Power Action Plan also introduced new criteria in auction design.

“The framework that the EU has set up allows streamlining procedures. Wind farms are classified as national strategic infrastructure, shortening permitting times. These rules have an impact, as we have seen in Germany, where they have been appropriately implemented. There, 60% more wind turbine permissions were granted in 2024.”

Infrastructure playing catch-up with renewable growth

According to Rosslowe, the growth of solar and wind power at this rate was unexpected, to the point that all other energy system elements–namely the grid and legislation–are “playing catch-up.”

“This is particularly evident given the urgency to reduce the dependency on Russian gas. To solve these grid connection issues, countries should prioritize the projects that bring the most value regarding energy security, cost efficiency, and feasibility, which are the guiding principles they should follow.

Wind Europe underlined the need for action to unblock grid capacity. The organization pointed out that over 500 GW of potential wind energy capacity is waiting for an assessment of their grid connection applications. At the same time, electricity grids are not expanding fast enough, told the industry union.

Chris Rosslowe

Senior Energy Analyst at Ember

He is the lead author of Ember's European Electricity Review 2025.

Wind power will accelerate, but further effort is necessary

In its paper, Ember analyzes the current state of the EU’s electricity transition. The report highlights how the transition continued in 2024, with solar remaining the fastest-growing source and outpacing coal for the first time. A dedicated chapter of the paper delved into the state of wind power. Although the EU’s wind capacity and generation remain growing, the COVID-19 pandemic and the war in Ukraine brought challenges to the industry.

The paper has a positive outlook on future developments as more projects are expected to be approved. “It is not just industry optimism, but it also comes from the fact that 2024 was a record year for wind power auctions in the EU. Despite the good foundation, this is not enough to achieve 2030 targets,” underlines the analyst.

As per the think tank’s analysis, the top priority is the application of the EU permitting rules by all countries. Still, there is a need for further policy changes. “In the case of onshore wind, spatial planning is an aspect that lawmakers need to get right. Auction designs need to be attractive, providing revenue certainty to investors.”

2025: a pivotal year for European wind power

Despite the challenges, 45GW of offshore wind auctions are in the pipeline for 2025, as S&P Global Commodity Insights reported in an analysis. Around a third of this auction pipeline will come from France, where the 9 GW AO10 tender auction will stand out as the largest of the year. Paris aims to have 18 GW of offshore installations by 2035.

September will be a key month for the Netherlands. Auctions for IJmuiden Ver Gamma-A, IJmuiden Ver Gamma-B, and Nederwiek I-A–each worth 1 GW of capacity–will all take place then. Although Dutch tenders don’t offer government support, they include a free grid connection. In addition, the government previously split the IJmuiden Ver Gamma site into two to mitigate the financial risks for developers.

To this extent, 2025 could be, according to analysts, the last chance to bring this capacity online by 2030–helping to comply with targets. These additions can also help further reduce reliance on fossil fuels for electricity generation, given the higher efficiency of offshore wind farms. The higher wind speeds and consistency in the current direction allow sea wind installations to produce more energy than the same capacity installed onshore.

EIB stepping in for wind power developments

Furthermore, the European Investment Bank (EIB) and the French bank Société Générale agreed on a new initiative to potentially unlock €8 billion in wind industry investments. The EIB will provide €500 million counter-guarantee to the French institute that the financial institution plans to use for creating a portfolio of bank guarantees worth €1 billion.

This money will support the development of new wind farm projects across the bloc. The EIB expects the counter-guarantee's leverage effect to stimulate funding from other investors, accelerating the development of other wind projects. This deal is part of an EIB €5 billion investment package in wind energy.

Although the actual effects of this tool are yet to be seen, Rosslowe is hopeful. “There is still time to change things, but not much. The next few years are critical to secure more investments and add new projects to the pipeline.”