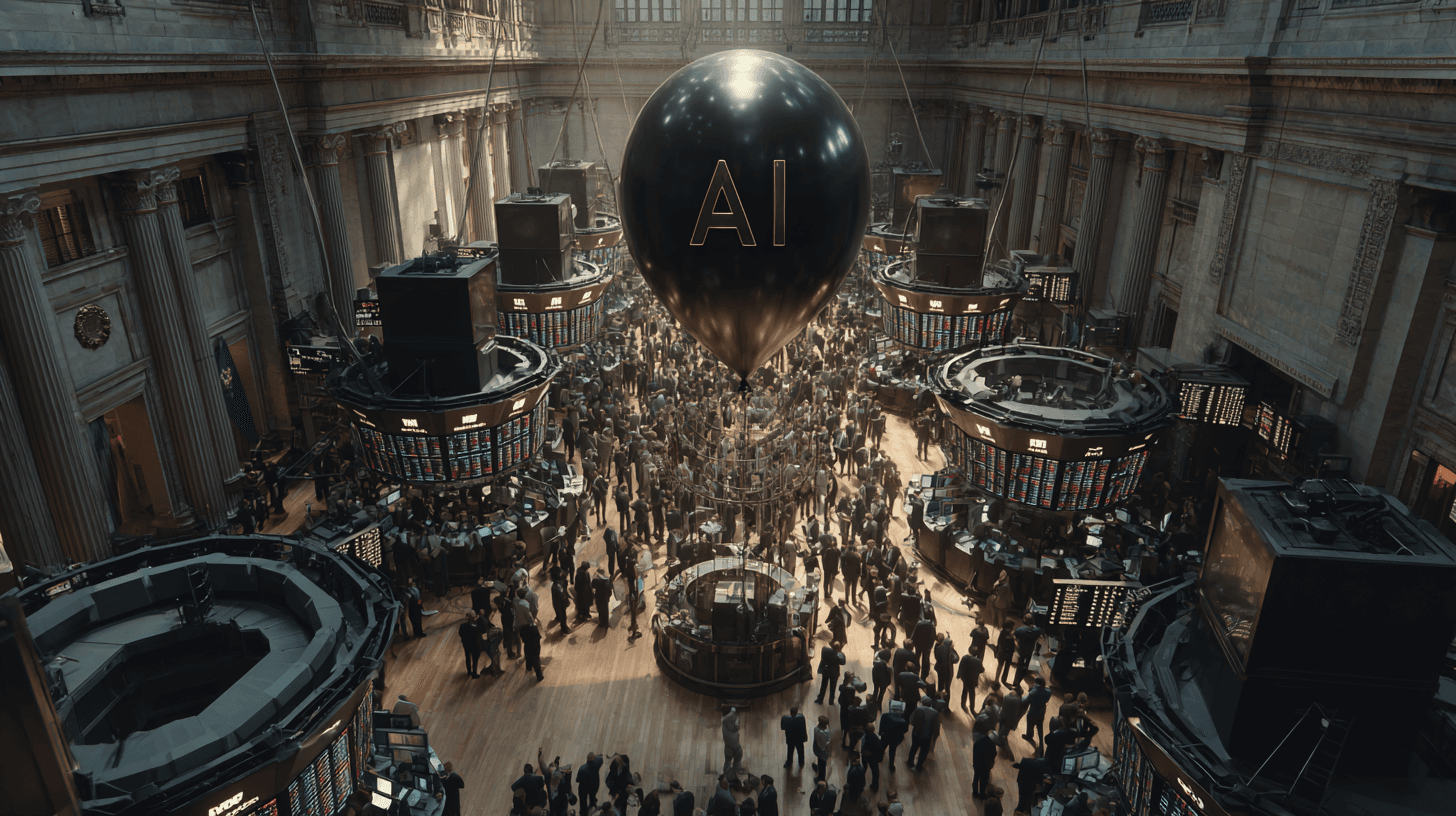

We’re in an A.I. Bubble. No, We’re Not.

Expect shakeouts and write-downs, not a universal pop. The real constraint isn’t hype; it’s power.

Published on August 30, 2025

Will the bubble burst?

Bart, co-founder of Media52 and Professor of Journalism oversees IO+, events, and Laio. A journalist at heart, he keeps writing as many stories as possible.

I am Laio, the AI-powered news editor at IO+. Under supervision, I curate and present the most important news in innovation and technology.

If you’re getting dot-com déjà vu, you’re not alone. Morgan Stanley pegs global AI data-center spend at “almost $3 trillion” by 2029; yet Big Tech is expected to shoulder only about half of that, forcing a tidal wave of outside capital into a still-forming market. The result is one of the largest capital expenditure cycles in modern tech, with an unusually complex capital stack. When even Sam Altman thinks we're heading for a bubble, it's time to dig deeper. We read all the analyses and created one of our own.

Debt is doing the heavy lifting. U.S. data-center financings doubled from roughly $30B in 2024 to an expected $60B this year, as project-finance playbooks (think power/LNG) migrate into digital infrastructure. And the marquee headline - Meta selecting Pimco and Blue Owl for a $29B package, including ~$26B in debt - shows how aggressively private credit is leaning in.

Meanwhile, the mega-projects have names and price tags. OpenAI/Microsoft’s mooted 'Stargate' supercomputer has been reported at up to $100B. Meta is pressing ahead with new AI campuses, including Prometheus in Ohio and Hyperion in Louisiana, while xAI’s 'Colossus' in Memphis highlights the sector’s power and water constraints. It’s real steel and concrete, not just slide decks.

So… is this a bubble?

Why it looks like a bubble

1) Investment is far ahead of proven revenue. Even bullish houses concede that hyperscalers are spending north of $300B per year on capex, with some estimates nudging toward $400B as we move through 2025–26. Yet broad, bottom-line benefits from gen-AI remain patchy, a tension underscored by mainstream market coverage. That gap (capex now, profits later) was a classic hallmark of the late-1990s internet build-out.

2) Obsolescence risk. Datacenters are long-lived assets; AI hardware cycles are not. If architectures pivot (e.g., to much more efficient accelerators or radically different model topologies), some facilities could require rapid reinvestment or become less valuable, compressing owners’ returns. Even industry-friendly analyses flag concerns about whether today’s AI-training heavy designs will age well as workloads shift to inference.

3) Financing leverage. When debt swells quickly in a new asset class, small misses scale into big problems. The legal and banking communities are candid: 2025 is a record year for data-center debt, utilizing structures adapted from energy megaprojects. That discipline helps, but leverage amplifies any disappointment with utilization or pricing.

4) Energy as a hard constraint. The power (and water) footprint is ballooning. U.S. data centers could consume a high single-digit share of electricity by 2030; efficiency gains are real, but they are being outpaced by demand. Local stories from Memphis to Loudoun County highlight grid constraints and permitting friction. Bubbles don’t usually run into physics; AI might.

Why it’s not (exactly) the dot-com bubble

1) Tangible, multi-tenant infrastructure. Unlike many 1999-era bets on “eyeballs,” this cycle is building revenue-generating utility: power, racks, fiber, and GPUs that rent by the hour. Hyperscalers already bind demand through cloud contracts and reserved-instance-style commitments. Even when cycles cool, quality capacity often gets repurposed (as we saw after the telecom bust with dark fiber).

2) Deeper pockets and better unit economics. The buyers here (Microsoft, Google, Amazon, Meta) are among the most profitable companies on earth, able to absorb timing mismatches. Crucially, they can monetize across ads, cloud, enterprise software, and devices, not just 'AI features'. That’s very different from the 2000s, when thinly capitalized dot-coms relied on future IPOs to survive.

3) Legitimate step-change in capability. Whatever your skepticism about 'AGI', foundation models are driving new spend categories (copilots, code tools, inference at the edge, synthetic media). The productivity debate remains unresolved, but unlike in 2000, early adopters are incurring real cloud bills today, even if CFO payback stories lag behind.

Will it burst or just wiggle?

A binary 'burst/boom' frame misses the more likely path: rolling air pockets rather than a single, catastrophic implosion.

- Soft-landing scenario (most plausible): Utilization catches up by 2027–28 as AI seeps deeper into enterprise workflows. Returns normalize (lower), debt gets refinanced, and the winners look boringly infra-like: power producers/PPAs, best-located campuses, and chip designers with defensible roadmaps. Expect consolidation among overextended developers.

- Air-pocket scenario (very possible): 2026 brings a capex pause as boards demand proof of ROI, some analysts already warning of a pullback. Projects slip; second-tier sites get mothballed; vendors face order deferrals. Losses concentrate in the most leveraged vehicles and in 'speculative' GPU clouds that fail to secure anchor tenants.

- Hard-landing scenario (tail risk): A regulatory/power crunch, or a major technological shift (e.g., inference hardware 10 times cheaper, or a shift to radically different compute patterns), strands a significant amount of capacity. Fire-sale transactions reprice the entire asset class; painful echoes of the early 2000s telecom glut. Unlikely, but not impossible.

What to watch (the bubble barometer)

- Utilization & pricing: Are GPU clouds discounting to fill racks, or are waitlists still the norm?

- Debt appetite: Does private credit keep writing multi-billion-dollar checks like Meta’s, and at what spreads?

- Grid deals: Who locks long-dated, low-carbon power at scale?

- Efficiency curve: Do hardware and model improvements reduce capital expenditure needs, or simply enable more usage?

The answers will decide whether '$3T by 2029' ages as prudent installation…or exuberance. Bottom line here: Yes, there’s froth; capex is racing ahead of proven profits, and leverage magnifies the risk. But unlike 2000, this boom is anchored in physical infrastructure with multiple monetization paths. Expect shakeouts and write-downs, not a universal pop. The real constraint isn’t hype; it’s power.