The Dutch startup ecosystem is at a crossroads

In the first episode of our new series Why we fail, we take stock of the current situation of the Dutch startup ecosystem.

Published on October 14, 2025

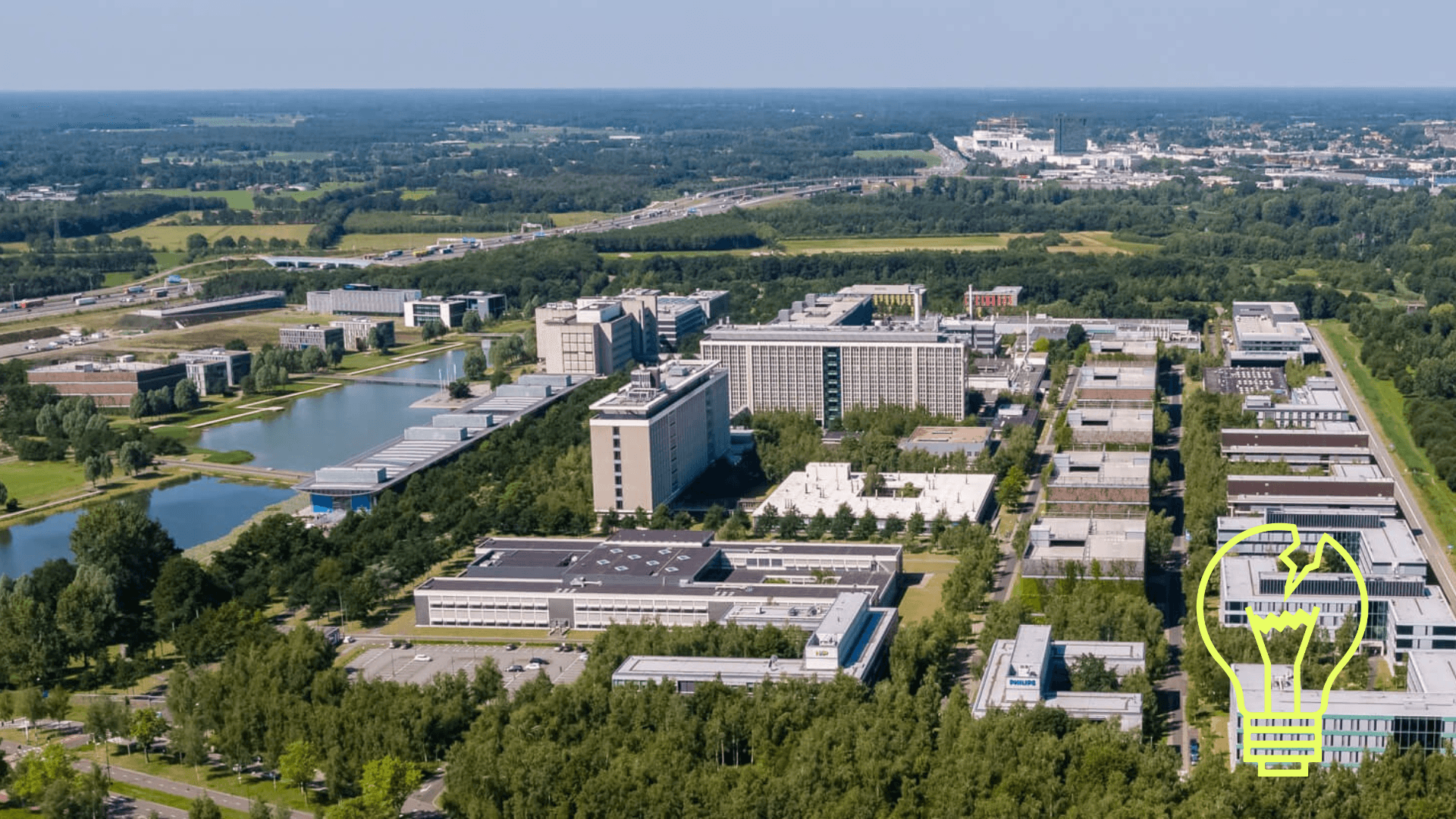

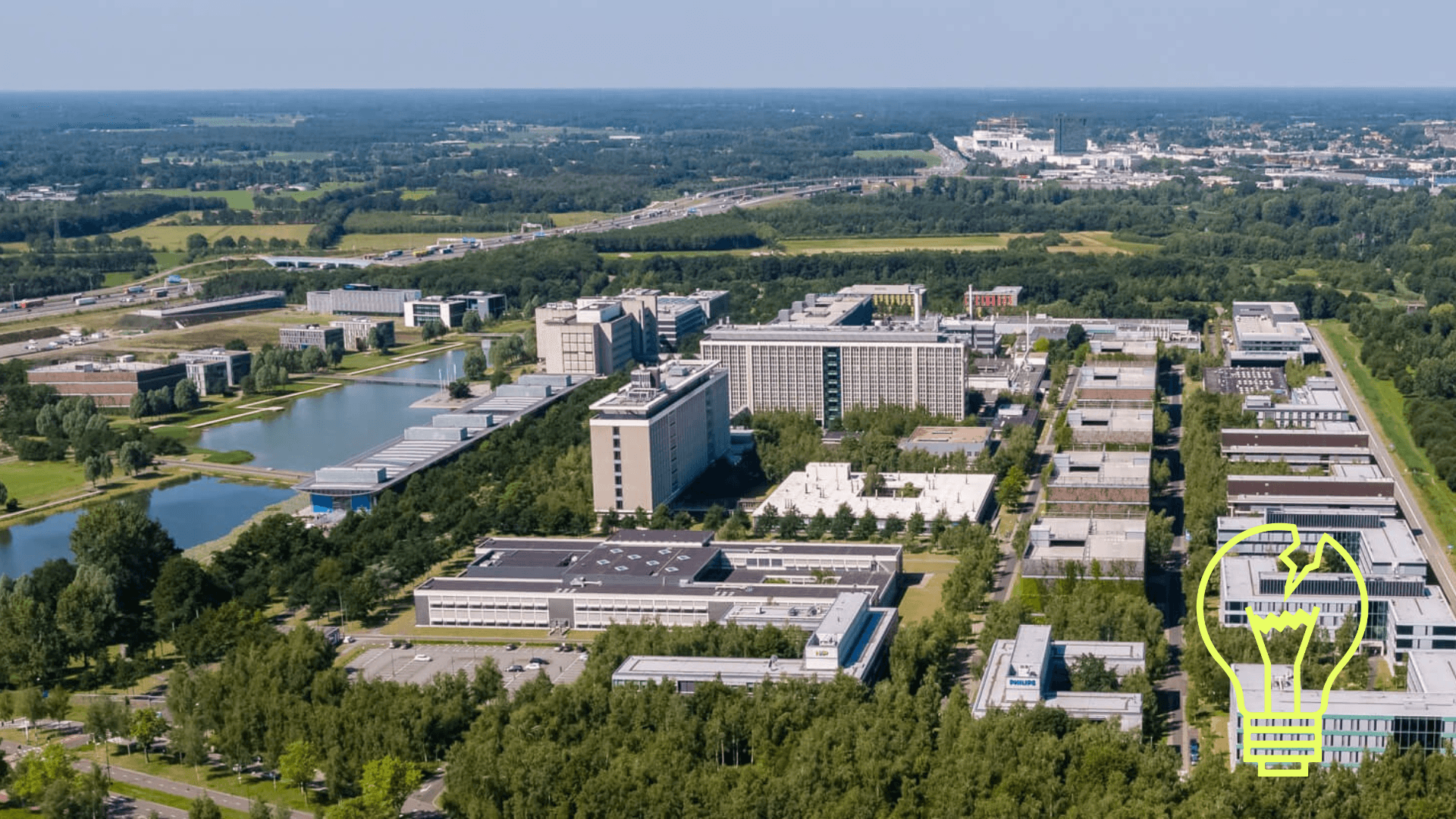

An aerial view of the High Tech Campus Eindhoven, the largest startup campus in the country - © HTCE

Mauro swapped Sardinia for Eindhoven and has been an IO+ editor for 3 years. As a GREEN+ expert, he covers the energy transition with data-driven stories.

The 2021 edition of Atomico’s State of European Tech defined the Netherlands as the “hottest tech hub in Europe.” The investment firm releases one of the most comprehensive overviews of the European innovation landscape annually. Back then, the analysis positively assessed the high number of startups per capita and unicorns — a definition given to private companies that reach a $1 billion valuation.

The success of startups is crucial to maintaining a competitive economy and society. According to TechLeap, a publicly funded nonprofit organization committed to developing the Dutch startup ecosystem, there were 10,799 tech companies in 2024. Atomico reports that these firms employ 255,000 people; in 2021, the headcount of tech employees topped 130,000.

Not only do these companies create jobs, but at heart, they are working in critical domains such as AI, energy storage, and medtech. Developing these technologies locally is crucial for addressing some of the pressing problems of our time, such as climate change, and reducing our reliance on foreign countries. In this episode of Why We Fail, we assess the current state of the Dutch startup ecosystem.

Why we fail - the struggles of the Dutch startup ecosystem

TechLeap’s State of Dutch Tech 2025 reveals a split: more scaleups, but fewer new startups secured €100K+ funding. Larger firms and scaleups are relocating—often to the US—for capital and growth, citing domestic hurdles like the nitrogen crisis and political instability. Key questions: Why are companies leaving? How can the Netherlands retain and attract innovative businesses to stay competitive?

Tough environment to scale a business

Nevertheless, despite praising the vitality of the Dutch ecosystem, Atomico’s 2021 analysis warned about some issues that could hinder further growth, including low investment levels in deeptech compared to other countries and struggles in accessing talent. These same two issues are still lamented by Dutch startups.

In recent months, entrepreneurs at various levels have expressed concerns about climate degradation, which hinders tech companies' ability to thrive. One such example is the message service company Bird, one of the 15 Dutch unicorns. In an interview with the newspaper Het Parool, Robert Vis, CEO of the company, announced that Bird would be leaving the country due to overregulation and a negative climate for the tech industry. “I have to secure Bird’s future and keep the company competitive, and that is unbelievably difficult to do in a country like the Netherlands.”

A poll last year revealed that nearly half of Dutch entrepreneurs don’t think the country is attractive for business, and a fifth of them are considering leaving. It can even get worse for budding startups, particularly those in deeptech. A deep tech company develops cutting-edge technology based on breakthrough science and engineering, and thus requires time and money to prove and develop its innovations. Many Dutch startups stem from academic work. According to the latest estimates by TechLeap, in 2024, there were 1342 deeptech startups in the Netherlands, roughly a tenth of the total number of startups.

How is the Dutch startup ecosystem doing at the moment?

TechLeap is a publicly funded non-profit organization committed to the development of the Dutch startup ecosystem. In addition to the services the organization offers to companies, it also releases a comprehensive report, ‘State of Dutch Tech,’ annually, providing an overview of the latest figures on the country’s innovation ecosystem.

€3.1 billion was invested in Dutch startups in 2024, marking a rise after two years of decline – yet still far from the peak registered in 2021— and countering the broader European trend of decline, as EU countries saw a 4.4% decline. Additionally, hospitality software company Mews and finance audit software firm DataSnipper have achieved unicorn status.

Although investment levels in the Dutch market increased, the overall number of funding rounds decreased by 20%. Early-stage funding also experienced a decline, while scale-up venture capital (VC) soared compared to 2023 levels, accounting for 40% of the total investments. Four rounds have collectively raised over €1.2 billion in this stage, with Nebius, an Amsterdam-headquartered firm offering AI intelligence infrastructure, leading the way with over € 600 million. In the charts below, you can find all the detailed figures.

Struggles to scale up and create new startups

The TechLeap report identifies two main problems at the ecosystem level: the decline in startup formation and the persistent low scale-up ratio. In 2024, 128 startups secured €100,000 in funding, representing a notable decline from the previous year.

According to the Organization for Economic Co-operation and Development’s (OECD) definition, a startup becomes a scaleup when it has seen annualized growth of at least 20% over three years, with 10 or more employees at the start of the period. The Netherlands has been lagging behind European peers such as Germany, Switzerland, and the United Kingdom. No European country comes close to the United States.

What industries are being funded the most?

In recent years, fintech and healthtech have been the industries that have attracted the most investments. In 2024, energy stood out as the sector where the largest share of investment was made, followed by foodtech. Interestingly, semiconductors are also one of the rising sectors, driven by Nearfield Instruments' Series C funding round, which is worth €135 million.

What are the Dutch tech hotspots?

Notoriously, Amsterdam is recognized as one of Europe’s hottest tech hotspots, home to fintech companies such as Mollie, Bunq, and Adyen. Figures collected by Dealroom report that since 2020, the province of North Holland—for those unfamiliar with Dutch geography, the one where Amsterdam is—has attracted $15 billion in investment.

North Brabant (where Eindhoven is located), South Holland – with its hotspots in Rotterdam, The Hague, Delft, and Leiden — and Utrecht follow, where at least a billion has been invested.

The ecosystem voices

Lots of figures to reflect on in this episode. But how do startups, investors, and ecosystem players look at the current situation? In the upcoming stories, the spotlight will be on all the actors of the Dutch startup ecosystem, allowing us to get to know their perspectives and ideas, and to give a new impetus, keeping the country competitive and innovative.

In the upcoming piece, we will put in the spotlight the story of a startup that, despite all of its efforts and the validity of its technology, failed.