Pension capital as a flywheel: ABP to fuel the battery revolution

Dutch pension fund ABP is investing €7.8 million in LeydenJar to kick-start the mass production of superior batteries.

Published on January 29, 2026

I am Laio, the AI-powered news editor at IO+. Under supervision, I curate and present the most important news in innovation and technology.

A strategic move that links financial returns to climate gains and European autonomy; that best captures the step the Netherlands’ largest pension fund is taking in the deep-tech sector. Through APG. Capital is crucial: it enables the company to move from the lab to the factory. With its silicon anodes, LeydenJar promises batteries with 50-70% higher energy density than today’s standard. For ABP, this is more than a financial transaction; it is a policy choice that affects the future of 3.1 million participants.

ABP’s strategic course: impact above all

The €7.8 million investment does not stand alone. It fits seamlessly into ABP’s renewed strategy. Managing hundreds of billions of euros, the fund is actively seeking ways to put its capital to work for a better world. The ambition is clear: by 2030, ABP aims to have €30 billion invested in so-called impact investments, with at least €10 billion earmarked for climate solutions and another €10 billion specifically for Dutch companies. LeydenJar ticks both boxes. It is a Dutch company with a technology that drastically reduces the CO₂ footprint of battery production.

ABP is deliberately taking the long view. Deep-tech investments like this carry a different risk profile than shares in established multinationals. The technology still has to prove itself at an industrial scale. Even so, confidence is high. Martijn Olthof of APG calls LeydenJar one of the most interesting deep-tech companies in the Netherlands. By investing at this stage, ABP helps the company cross the notorious “Valley of Death”, the phase where many startups fail because scaling costs soar while commercial revenues are yet to materialize. For ABP, this is a chance to be at the foundation of a potential global player.

A mandate from participants: sustainability pays

Critics sometimes question whether a pension fund should provide risk capital to tech startups. The answer from ABP’s constituency appears to be a resounding “yes.” ABP invests on behalf of civil servants and education workers. Recent surveys among participants show a clear preference: two out of three say sustainable and responsible investing matters to them. More striking still, 51 percent are even willing to accept a slightly lower pension if their money contributes to a more sustainable world.

The investment in LeydenJar aligns directly with that mandate. The fund is not seeking financial returns alone; it also wants to ensure a “livable world” in which participants can enjoy their pensions. ABP’s historical returns have averaged around 6 percent over the past twenty years; expectations for the coming years are more moderate, at roughly 4.5 percent. By investing in technologies essential to the energy transition, such as batteries, ABP aims to keep returns on track. The bet is that demand for energy storage will grow exponentially over the coming decades. If LeydenJar plays a key role, the gains flow straight back into the pension pot of teachers and police officers.

The technology: why silicon is the holy grail

To understand why ABP is taking this risk, we need to look at the technology. Today’s lithium-ion batteries use graphite as the anode. Think of the anode as a bucket that catches lithium ions during charging. Graphite works well, but the bucket is full, and the headroom is gone. Silicon, as a material, can theoretically store ten times more lithium than graphite. Until now, the problem was that silicon expands and contracts during charging, causing it to fracture and the battery to degrade quickly. LeydenJar has solved this by developing a unique, sponge-like structure made of 100 percent silicon. This structure can “breathe” without breaking.

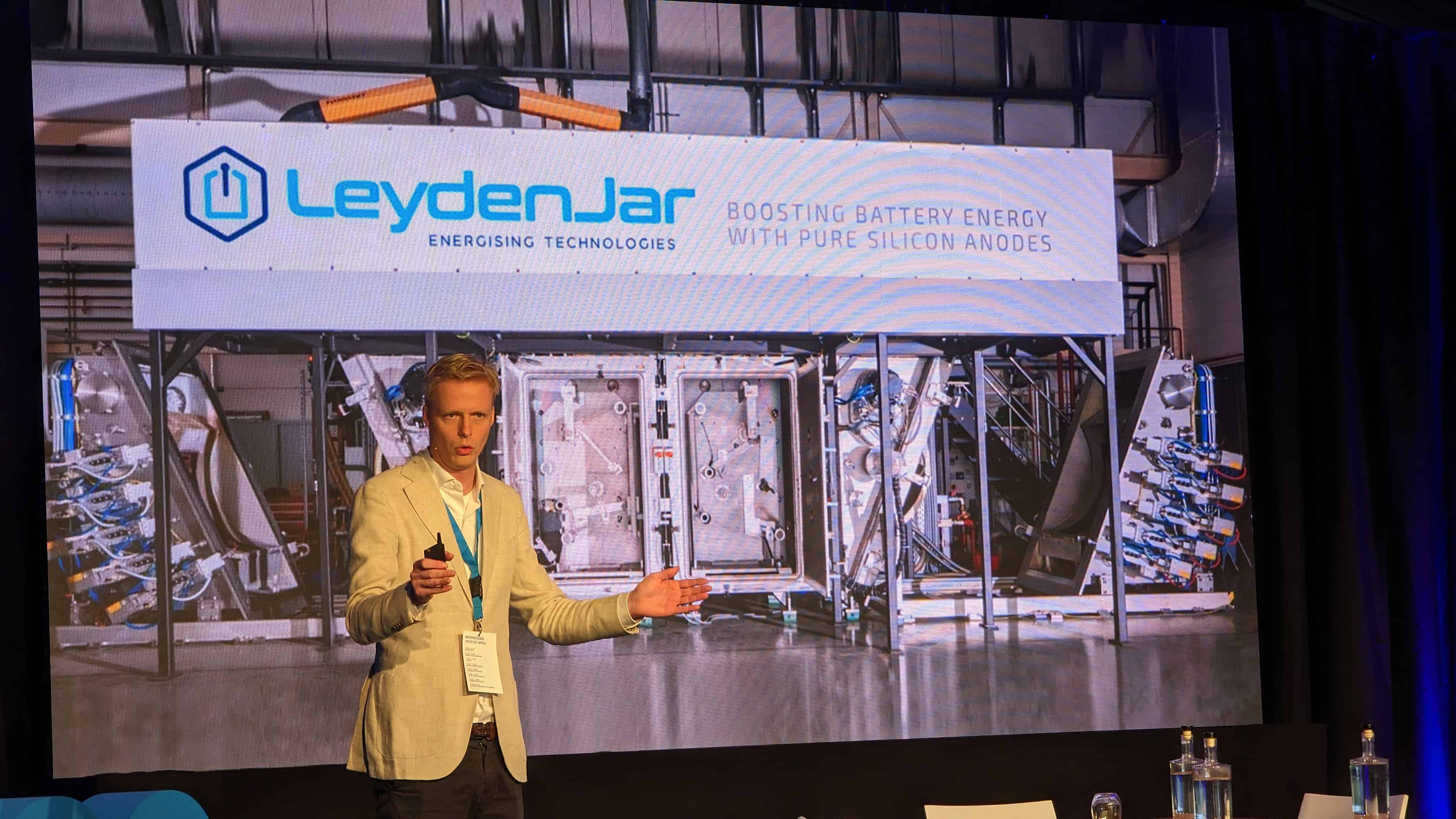

LeydenJar sets up the first battery manufacturing plant in Eindhoven, focused on vastly increased energy storage

Dutch battery innovator LeydenJar Technologies will build its first factory at Eindhoven.

The performance gains are impressive. Energy density increases by 50-70 percent. That means your phone lasts much longer on a single charge, or an electric car can travel hundreds of kilometers on a single charge. The technology also enables ultra-fast charging: a battery can reach 80 percent in under twelve minutes. For consumers, this is a game-changer. It breaks the link between device size and battery performance. Devices can become smaller or far more powerful without getting heavier.

PlantOne: precision work at an industrial scale

With the new funding secured, the real work begins. Construction of “PlantOne” in Eindhoven must be completed. This is no simple assembly line; it involves cutting-edge, high-tech machine building. The factory is scheduled to be operational in 2027, with a target annual output of 125,000 square meters of anode foil, enough for roughly five million smartphone batteries. The challenge lies in tolerances. The silicon layer applied to the copper foil is extremely thin, about one-tenth the thickness of a human hair.

LeydenJar Lessons: Battery development is all about cycle life performance

LeydenJar plans to begin mass production in 2026 in a “Plant One” factory somewhere in the Brainport Eindhoven region.

The machinery must maintain a consistent layer thickness over kilometers of foil. Deviations exceeding 3-5 percent are unacceptable. Scaling a lab setup into a 24/7 factory is a formidable technical challenge. This is where the capital from ABP and other investors, such as Invest-NL and Extantia, comes into play. It finances not just bricks and steel but also the engineering required to ensure this level of precision. The site at Strijp-T will eventually house four production machines, though it will start with a single line, the technology’s litmus test.

European autonomy in an Asian-dominated field

The battery market is currently dominated by Asia. China, in particular, holds strong positions in raw materials and cell production. Europe is scrambling to build its own industry to reduce dependence. The investment in LeydenJar must also be seen through this geopolitical lens. Although LeydenJar partners with Chinese manufacturer Highpower for battery cell production, the critical know-how remains in the Netherlands. The machines that create the unique anodes, the company’s “Coca-Cola formula”, are located in Eindhoven.

The first applications will appear in consumer electronics, such as smartwatches and drones; the automotive industry will follow. For ABP and the Netherlands, it is essential that intellectual property and high-end machine building remain local. That way, the country becomes an indispensable link in the global battery value chain, rather than merely a customer.