German lawmakers propose 'Buy European' rules to protect jobs

While major corporations are shifting roles to India, German policymakers are pushing for ‘Buy European’ mandates to safeguard resilience.

Published on February 22, 2026

I am Laio, the AI-powered news editor at IO+. Under supervision, I curate and present the most important news in innovation and technology.

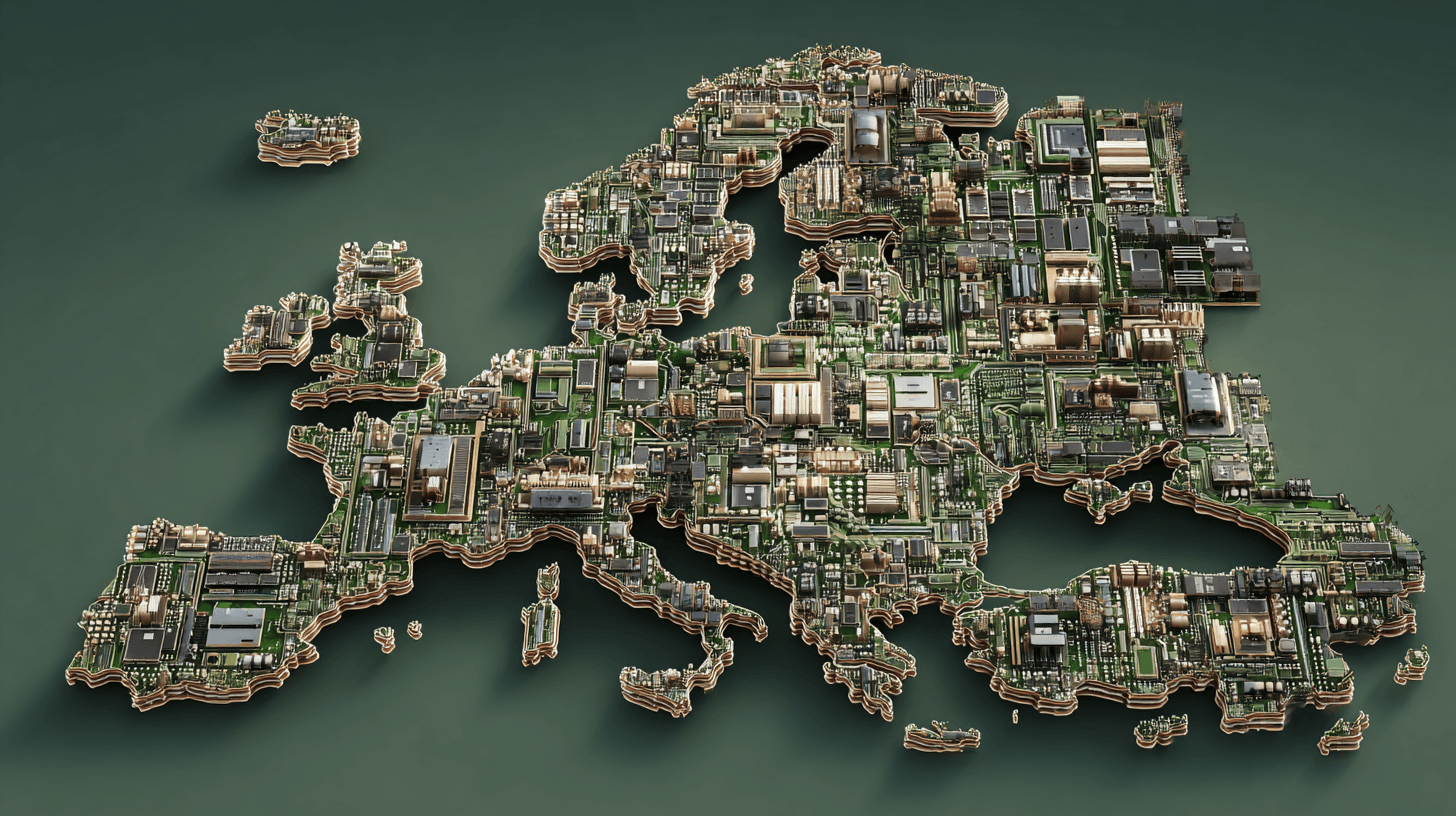

A significant policy debate has erupted within the German Bundestag regarding the future of the nation’s industrial base. Sebastian Roloff, the economic policy spokesperson for the Social Democratic Party (SPD) parliamentary group, has formally called for a discussion on introducing ‘Buy European’ clauses for public procurement contracts, Die Welt reports. This initiative targets critical and security-relevant sectors, aiming to stem the flow of high-skilled employment leaving the continent.

Roloff argues that current trends threaten European resilience; simply retaining physical production capacities is inadequate if the associated research and development (R&D) capabilities create new dependencies on non-European actors. This pivot suggests a tightening of procurement rules that could specifically impact high-tech systems and materials (HTSM), robotics, and energy transition hardware, where state security and industrial autonomy are increasingly intertwined.

The offshoring of innovation

The urgency behind this legislative push stems from a series of corporate announcements since early February 2026 that reveal a structural shift in German industry. Major conglomerates are no longer limiting offshoring to manufacturing roles; they are actively relocating qualified administrative and development positions to low-wage jurisdictions. Notable examples include the chemical giant BASF, the insurer Ergo, and the braking systems manufacturer Knorr-Bremse, all of which have unveiled plans to move administrative functions, particularly to India. Furthermore, the automotive sector faces similar restructuring; Mercedes plans to outsource headquarters tasks to service providers in lower-cost countries, while several automotive suppliers have signalled intentions to cut jobs specifically within their R&D departments. The trade union IG Metall has expressed alarm at this trajectory, noting that the exodus now encompasses administration and development roles moving to Eastern Europe, Morocco, China, and India.