EU's U-turn on combustion engines ban: complexity over clarity

EU reverses ICE ban, creating uncertainty and slowing EV adoption in Europe.

Published on December 18, 2025

© Maxim Hopman - Unsplash

Mauro swapped Sardinia for Eindhoven and has been an IO+ editor for 3 years. As a GREEN+ expert, he covers the energy transition with data-driven stories.

On Tuesday, the European Commission reversed the existing phase-out of internal combustion engine (ICE) sales for 2035. The proposal, part of the Automotive Package, introduces new exemptions for plug-in and hybrid vehicles. Opponents view this plan as a move that would create market confusion and significantly slow down electrification.

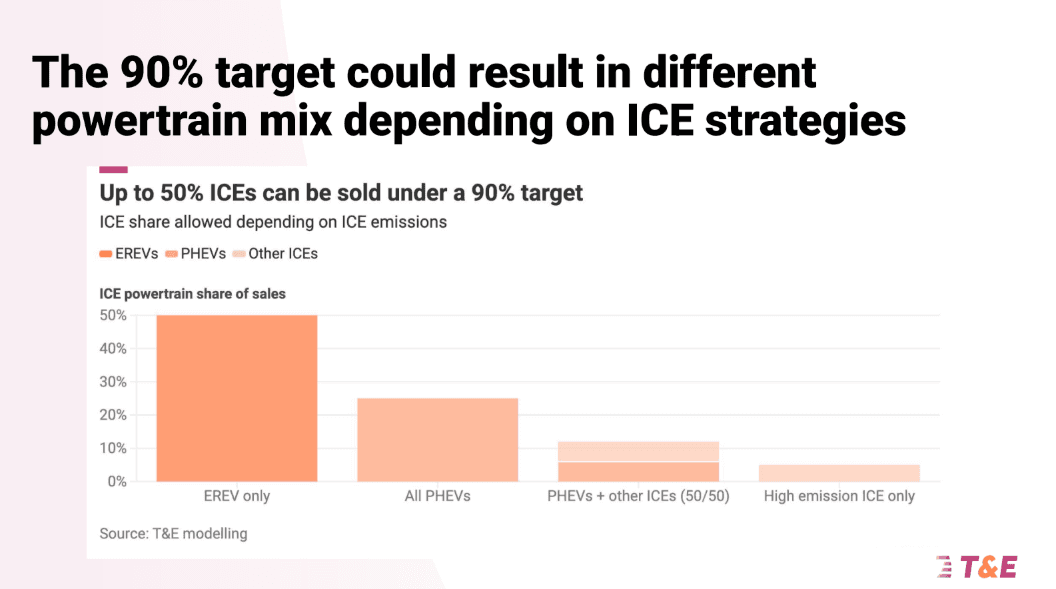

The proposal weakens the previously set targets. By 2035, carmakers will need to meet a 90% reduction in tailpipe emissions. The remaining 10% of emissions will need to be offset by using EU-made green steel (up to 7%) and renewable fuels (the remaining 3%). This means it will still be possible to sell plug-in hybrids (PHEVs), range extenders, mild hybrids, and internal-combustion-engine vehicles beyond 2035.

The watered-down targets come in a year where European and global electric vehicle (EV) sales are breaking records. In particular, EV sales in Europe surpassed 3.8 million in November—33% higher than the first 11 months of 2024.

Casting uncertainty

William Todts, executive director at leading mobility non-governmental organization Transport & Environment (T&E), said: “The EU has chosen complexity over clarity. Breeding faster horses could never have halted the ascent of the automobile. Every euro diverted into plug-in hybrids is a euro not spent on EVs, while China races further ahead. Clinging to combustion engines won't make European automakers great again.”

Automakers now have greater flexibility to choose which strategies to pursue and which powertrains to bring to market. “Yet, these strategies matter a lot for stakeholders such as consumers and grid operators, creating further instability,” Todts added.

Chris Heron, Secretary General of E-Mobility Europe, a trade association uniting the European e-mobility ecosystem, commented on the proposal. “It’s the wrong time for Europe to take the wind out of its own sails. Europe’s electric car markets are growing strongly in 2025, yet by reopening the door to plug-ins, hybrids, and unscalable biofuels, we risk slowing ourselves down in a highly competitive global race. The future of transport is electric; Europe needs to recommit to building it as we move forward. ”

Last week, the trade association sent the Commission a letter—alongside 200 signatories, including carmakers Volvo and Polestar—to maintain the 100% zero-emission target.

Significant BEV slowdown

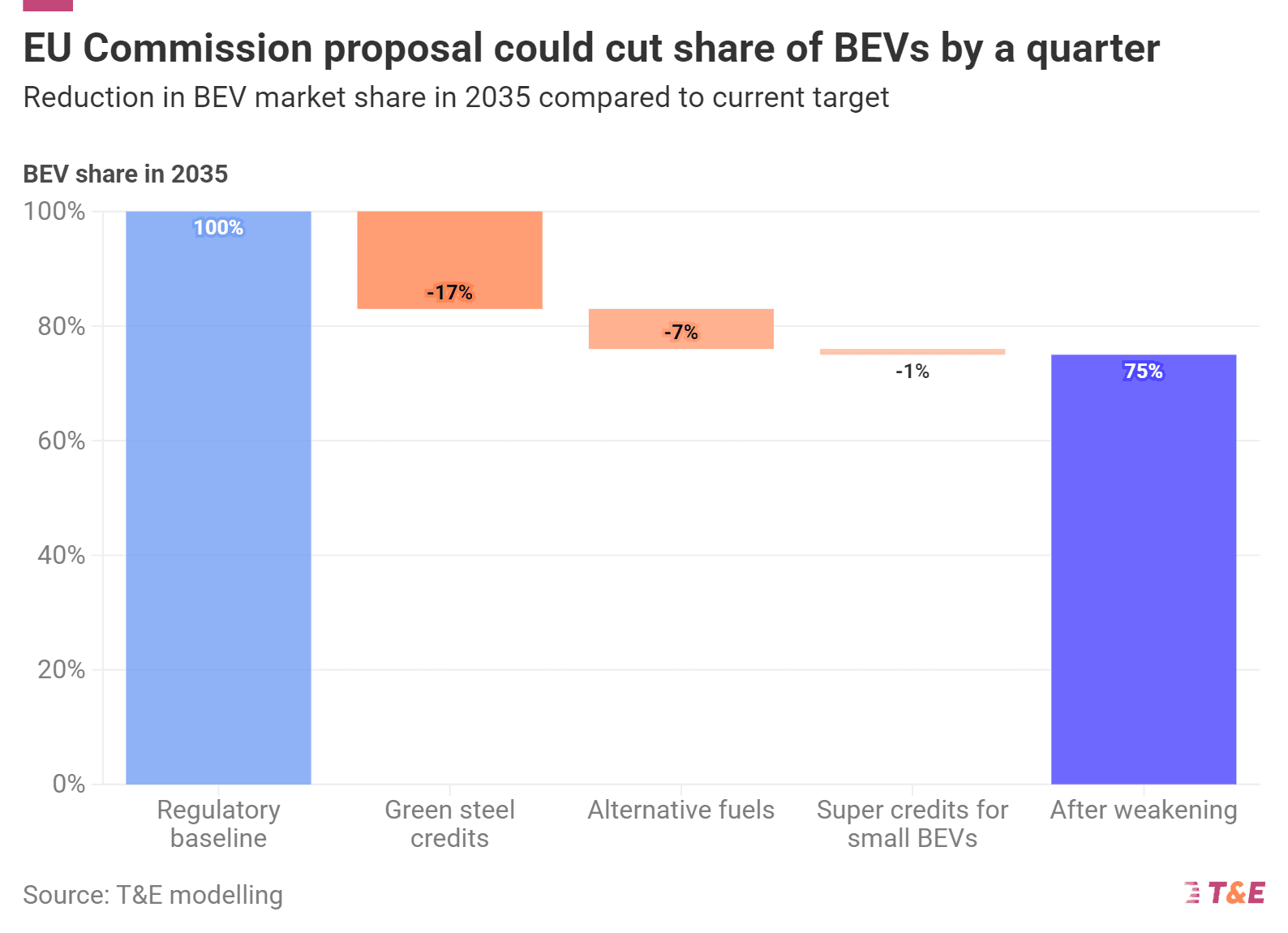

According to a T&E analysis, the Commission’s proposal could cut the market share of battery-electric vehicles (BEVs) by a quarter by 2035. The same study also underscores the uncertainty the Package creates, as the 90% target could lead to different powertrain mixes depending on the strategies automakers adopt.

© T&E

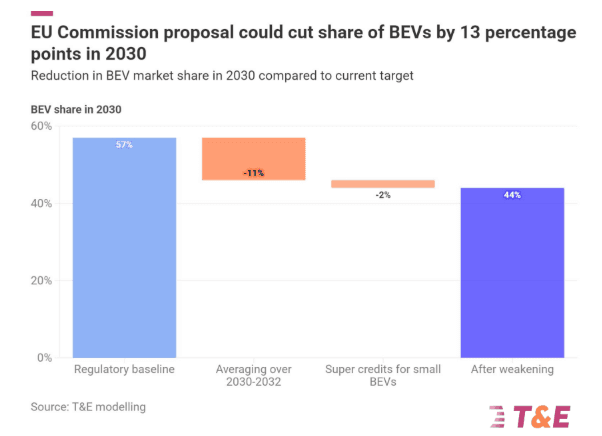

In addition to the green steel and renewable fuels compensations, the Package also introduces “super credits” for small, affordable EVs made in the EU. This measure targets so-called e-cars under 4.2 meters long.

This plan presents a 1.3 multiplier, meaning that every tiny electric car sold counts as 1.3 zero-emission cars toward a carmaker’s CO2 target, reducing the number of EVs they would need to sell overall. Additionally, carmakers, during the period between 2025 and 2027, are allowed to average their emissions on the path to 2030.

© T&E

The struggle to compete with China

With the Chinese car manufacturer BYD now the world's leading EV brand, China has the upper hand, as other manufacturers, such as NIO and Xiaomi, can target the market with lower-priced cars. The Commission claims the Package—which results from the strategic dialogue it started with all industry stakeholders—will make the European car industry more competitive.

Since October last year, the Commission has imposed import duties on Chinese EVs. The tariffs can be up to 35.3% of the car price, in addition to the existing 10% import tariff. In the first half of 2025, no Chinese BEV showed up in the top 10 of the most sold EVs in Europe.

Earlier this year, EU officials also watered down this year's emission compliance targets, allowing carmakers to meet them by 2027. The Automotive Package is yet another concession to car manufacturers, particularly German and Italian ones, who pushed to reverse the ban.

Strengthening the battery value chain

Under the Automotive Package umbrella is also the Battery Booster. The initiative—backed by €1.8 billion in financing—aims to develop a domestic battery value chain. The largest share of this amount (€1.5 billion) is allocated to European battery cell producers, who will be eligible for interest-free loans.

The Commission also announced that further measures will be implemented to strengthen the sector's cost competitiveness and secure the materials supply chain. The battery is the single most expensive component of an EV. Chinese producers such as CATL dominate the market, selling the majority of the batteries that are in the market today.

The future remains electric

According to T&E, a positive aspect of the Automotive Package is the introduction of national electrification targets for large company fleets. Yet the NGO points out that these are not ambitious enough to drive uptake in a sector that accounted for 58% of new registrations in the second quarter of 2025.

Despite the uncertainty the plan casts, both T&E and E-Mobility Europe are confident the future will be electric. “Once the dust has settled, we’re confident the core of the 2035 framework will still matter more for the market than today’s exemptions. The world’s transition to electric vehicles is irreversible, shaped by cost and efficiency,” stated Heron.