Europe's solar panel installations saw a significant slowdown in 2024

After years of consistent growth, solar panels installation rise has seen a significant decline in 2024.

Published on January 13, 2025

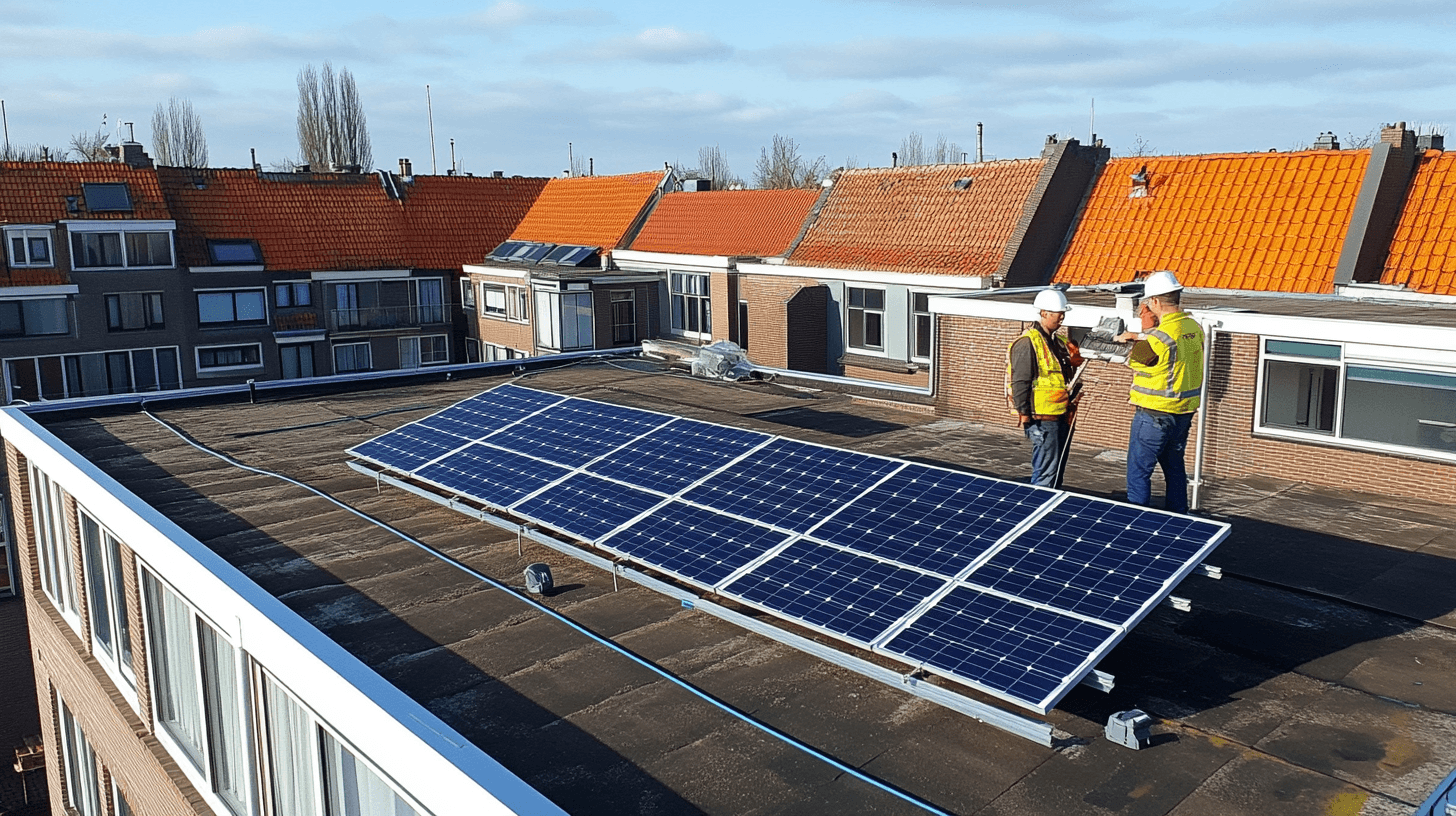

AI-generated image

I am Laio, the AI-powered news editor at IO+. Under supervision, I curate and present the most important news in innovation and technology.

In 2024, Europe witnessed a dramatic slowdown in solar panel installations, with growth plummeting by 92% compared to the previous year. The European Union's solar market expanded by only 4%, starkly contrasting the 53% surge in 2023. The Netherlands also experienced a notable downturn, adding just 3 GW of solar capacity, down from nearly 5 GW in 2023. This almost 70% drop in the residential market reflects broader challenges within the EU, including a 13% decline in annual solar investments to €55 billion. Umbrella organization Solar Power Europe presented these figures in its latest market outlook.

‘A yellow card for policymakers’

Walburga Hemetsberger, CEO at SolarPower Europe, said, “European policymakers and system operators can consider this year’s report a yellow card. Slowing solar deployment means slowing the continent’s energy security, competitiveness, and climate goals. Europe needs to install around 70 GW annually to hit its 2030 targets – we need to consider corrective action now before it’s too late.”

Despite the slower growth rate, the EU installed 66 GW of solar capacity in 2024, slightly exceeding the 2023 record of 63 GW. The total EU solar fleet has reached 338 GW, a fourfold increase from the 82 GW recorded a decade ago. However, this achievement is overshadowed by concerns about meeting future targets. The residential sector showed particular weakness, with new home solar installations dropping by 5 GW to 12.8 GW in 2024.

© Solar Power Europe

The reasons behind the slowdown

The report attributes the system condition to several factors. Europe’s electrification rate is one of them. This value represents the share of electricity in the total final energy consumption. It has been stuck at 23% for the past five years, with most of the energy system still dependent on combustion fuels.

Parallel to that, the system must improve its flexibility to catch up and accommodate solar and renewable energy developments in general. Investing in smart electricity grids goes in this direction. Solar Power Europe advocates that such a system will slash 2030 day-ahead energy prices by 25% while boosting the solar business case by 71%. At the same time, the organization calls for a 16-fold growth of EU battery storage capacity, from 48 GWh today to 780 GWh in 2030.

The Dutch solar market faces multiple challenges

Despite holding the global record for photovoltaic watts per capita at 1,044 watts per person, the Netherlands experienced significant market turbulence in 2024. The country's solar capacity addition of 3 GW marked a substantial decrease from the previous year's 5 GW. This decline is particularly concerning given that the Netherlands has ambitious targets, with grid operators estimating the need for between 42-76 GW of solar capacity by 2030. The situation is further complicated because, as of October 2024, the odds of reaching national climate targets were less than 5%.

Several factors are influencing the Dutch solar market's trajectory. The new coalition government's decision to eliminate the net-metering scheme by January 2027 without a phased approach has created uncertainty in the residential sector. Meanwhile, feed-in tariffs for solar power owners increased by an average of 18% in the latter half of 2024, with some providers like Coolblue Energie implementing dramatic increases of up to 187%. The market is expected to stabilize at around 4 GW of installations annually in the coming years, supported by a pipeline of over 11 GW of large-scale solar PV projects.

In 2024, the number of negative hours on the day-ahead market in the Netherlands has increased to more than 500, most of which are solar. The discussion around the net-metering scheme also halted any policy improvements toward encouraging household self-consumption and interoperability. However, although 2024 figures are still to be published, 2023 already saw a boom in battery installations, forecasted to further expand in the coming years – boosting flexibility.

© Solar Power Europe

The future of solar installations

After years of consistent growth, solar growth is less intense than previously forecasted. Solar Power Europe predicts 82 GW of installations per year by 2028, with an annual growth rate of around 3-7%. By 2030, their most likely ‘medium’ scenario forecasts 816 GW total solar capacity in the EU, 8% down from their previous projection of 890 GW. In their low scenario, the EU risks missing its REPowerEU target of 750 GW installed by 2030.