Dutch startup ecosystem remains in the global top 10

The Global Startup Ecosystem Index report by StartupBlink shows international competition increases. Switzerland passed the Netherlands.

Published on June 21, 2025

Bart, co-founder of Media52 and Professor of Journalism oversees IO+, events, and Laio. A journalist at heart, he keeps writing as many stories as possible.

The Netherlands maintains its position in the global top 10 startup ecosystems in 2025. However, the latest Global Startup Ecosystem Index report from StartupBlink shows that international competition is gaining ground. Switzerland, in particular, is making significant efforts. What does this mean for the Dutch ecosystem?

In 2025, the Netherlands ranks tenth in the Global Startup Ecosystem Index. This puts our country among the absolute world leaders, but it is striking that Switzerland, with strong growth (31.8%), has just overtaken the Netherlands this year and now ranks ninth. The Netherlands itself achieved solid growth of 26.2%, which is in line with the average growth rate for Europe.

The top of the global ranking is still dominated by the ‘big three’: the United States (1), the United Kingdom (2), and Israel (3). It is interesting to note that the growth rate of the US is starting to slow down: only 18.2% growth, the lowest of the top 50. This means that the relative difference with other countries is slowly decreasing, but the US remains the undisputed market leader. Europe as a whole grew by 26.2%, outperforming North America (15.7%), which offers hope for further catching up in the future.

© Startupblink

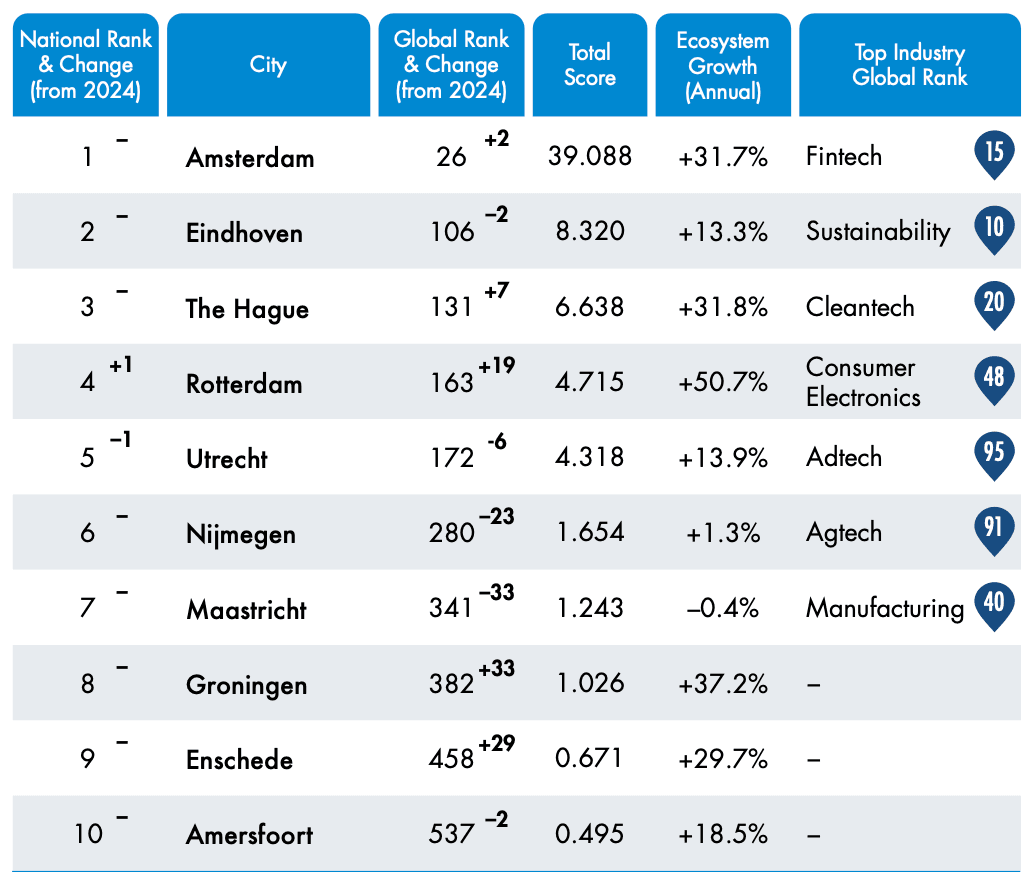

Amsterdam reigns supreme

Amsterdam continues to dominate the Dutch startup ecosystem, now with a total score five times higher than that of Eindhoven, its closest competitor. Amsterdam climbs two places to 26th place worldwide.

However, it still needs to return to the global top 20, a position it held in 2020. The city remains in 5th place in Europe and 4th place in the EU for another year. Amsterdam particularly excels in fintech, where it ranks 15th globally and 3rd in the EU.

Despite ranking 2nd in the Netherlands, Eindhoven recorded the lowest growth of the top 5 Dutch cities and dropped two places in the global rankings (to #106). Still, Eindhoven is honored as one of the "inspiring examples of small cities punching above their weight".

Nationally, Rotterdam is the only city in the Dutch top 10 to rise, moving up to 4th place, overtaking Utrecht. The difference in score between the two cities remains minimal, but Rotterdam is growing much faster. The growth of Rotterdam's ecosystem, at over 50%, is the highest among the top Dutch cities and helps the city achieve the largest increase in the Dutch top 10, rising 30 places in two years. Maastricht is the only Dutch city in the top 10 to record negative growth.

© Startupblink

Strong sectors in the Netherlands

The underlying sector analyses show that the Netherlands is particularly prominent internationally in the Healthtech, Energy & Environment, and Foodtech sectors, which are among the fastest-growing industries worldwide. Foodtech and Energy & Environment, in particular, are growing globally by more than 40%. This is in line with the Netherlands' strengths in agri-food, energy transition, and sustainable technology. Eindhoven is the only Dutch city with a position in a top 10 category: sustainability.

The report emphasizes that geopolitical developments and the rise of AI are fundamentally changing the global playing field. Countries that invest in stable regulations, secure markets, and attractive business climates will reap the benefits. The Netherlands is benefiting from this, but according to the report, it must continue to invest in international positioning, talent development, and access to capital.

CEO Eli David of StartupBlink points out in the report that “small ecosystems can benefit more quickly from the mistakes made by large ecosystems.” Cities such as San Francisco and Seattle in the US are losing ground due to security issues and high costs. This creates opportunities for more stable ecosystems in Europe, provided they continue to develop. According to the report, the Netherlands faces challenges in expanding startup activities beyond Amsterdam, strengthening its capital market, and implementing targeted policies to attract international talent.