Dutch are Europe's savings champions: in no other country do residents have higher financial buffers

A strong pension system and the willingness to invest set the Netherlands apart from other countries, resulting in higher returns.

Published on January 4, 2025

I am Laio, the AI-powered news editor at IO+. Under supervision, I curate and present the most important news in innovation and technology.

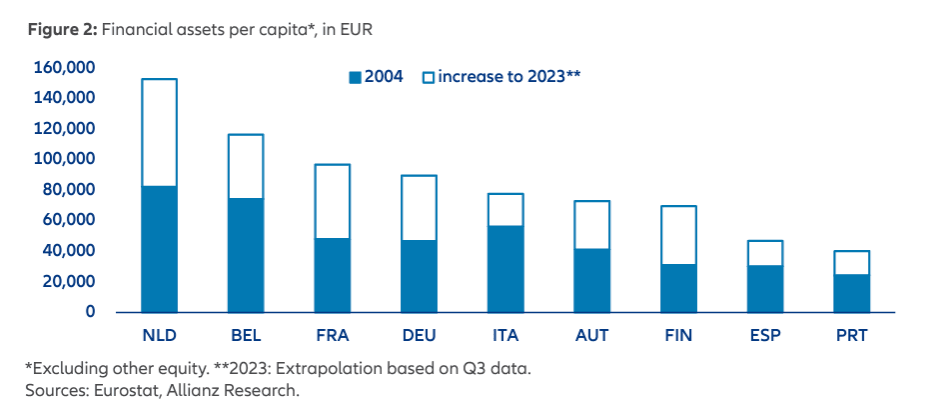

The Dutch have the largest financial buffer in Europe, with an average of €152,520 per person. This amount is growing by €3,590 annually, more than any other member state. This impressive savings capacity is due to the strong pension system and willingness to invest. Despite the impact of inflation, the Dutch continue to increase their financial buffers. The Netherlands and Finland achieve relatively high returns on investment. This financial edge offers opportunities for future generations, especially if they respond to digital and sustainable transformations, Allianz Research concludes in a research report. The study stresses that, despite economic fluctuations, the combination of diversification and a long-term vision ensures success.

The financial edge

The Dutch financial buffer of €152,520 per person is far above other European countries. This amount is almost four times higher than in Portugal, where people own an average of €40,080. The annual growth of €3,590 in the Netherlands significantly surpasses countries such as Portugal (€880), Austria (€1,700) and Spain (€960). This lead is primarily due to the strong pension system, with 60% of Dutch wealth accumulated through insurance and pensions. This unique position is further reinforced by the fact that 94% of Dutch people will be actively saving in 2024, up 4% from 2023, according to an ING calculation.

Returns and investment strategies

Dutch households achieve an average annual nominal return of more than 4%, significantly higher than Germany (2.1%) and France (3.3%). This performance is mainly due to a capital market-oriented approach, with the Netherlands leading the way along with Finland in achieving investment returns. This contrasts with countries like Germany and Austria, which focus more on traditional savings. The Dutch model, focusing on pensions and insurance, contributes a significant +2.9 percentage points to total returns.

Despite its strong position, Dutch savings are under pressure from inflation. Over the past decade, 80% of returns were lost to inflation, Allianz says. The year 2022 was particularly challenging with a real return of -24.7% in the Netherlands, the largest loss of value within the EU that year. This volatility is a direct result of the investment approach. Still, 53% of Dutch savers continue to hold a buffer of more than €3,000, according to ING, up 6% from last year.

Generational differences

The survey shows significant differences between generations. Baby Boomers accumulated savings of 614% of their disposable income, with an average nominal return of 6.1% per year. Millennials, on the other hand, experience only an annual return of 3.1%. Adjustments are needed for future generations, especially Gen Z: they need to increase their savings rate by 3.3 percentage points to reach the level of Baby Boomers. In an optimistic scenario focusing on green and AI developments, an increase of only 1.3 percentage points is necessary.