Brabant has 768 startups and scale-ups; scaling remains challenge

Braventure's new report 'Startup Insights North Brabant' shows the province is among Europe’s leading startup and scale-up regions.

Published on January 29, 2026

Bart, co-founder of Media52 and Professor of Journalism oversees IO+, events, and Laio. A journalist at heart, he keeps writing as many stories as possible.

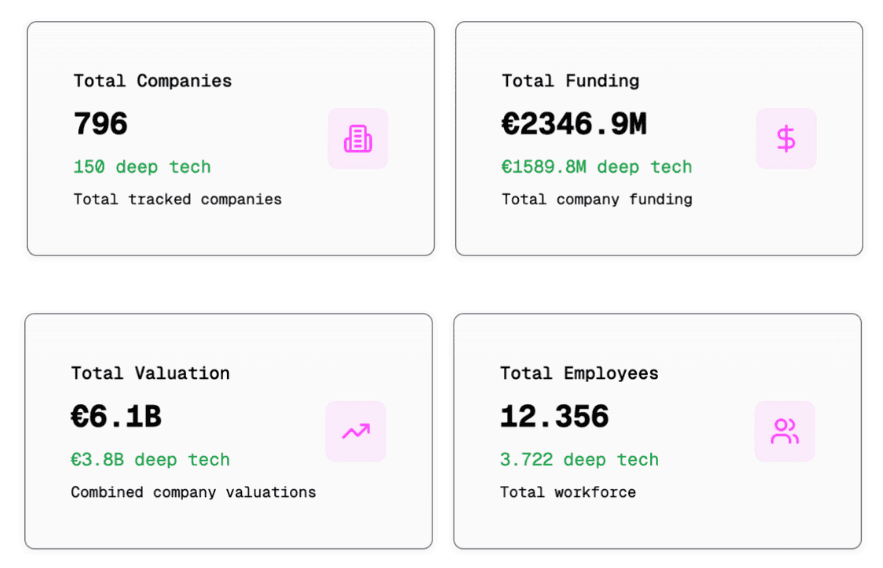

Over the past few years, Brabant has firmly established itself as one of Europe’s leading startup and scale-up regions. This is evident from the new report Startup Insights North Brabant, in which Braventure maps the development of the Brabant startup ecosystem over multiple years. The province is now home to 768 startups and scale-ups, together accounting for more than €1.9 billion in capital raised and almost 11,000 jobs. At the same time, the report makes clear where the real bottleneck lies: growing to an international scale remains difficult.

According to Matthijs Bulsink, Data & Product Lead at Braventure and compiler of the report, the explicit aim is to look beyond individual success stories. “The idea is to show the full picture of Brabant: where the strengths are, how the regions are developing, and where we as an ecosystem need to improve together,” he says. Not as a snapshot, but as a multi-year retrospective.

Deep tech as the common thread

One of the most striking conclusions is that around 70% of all investments in Brabant go to deep-tech companies. This aligns the province with a broader European trend, but with a distinct local profile. Brabant hosts several global value chains, with semicon and deep-tech in Brainport Eindhoven, pharmaceutical and biotech innovation around Oss, and new proteins and food tech in West Brabant.

© Braventure

In total, Brabant-based startups and scale-ups have raised more than €1.9 billion in funding since 2010. Their combined company valuation is estimated at around €5.8 billion. This makes Brabant a serious player in the Dutch startup landscape, especially given its strong focus on technologies that support societal transitions in health, sustainability, and digitalisation.

Brabant captures a larger share of Dutch investment capital

Notably, Brabant has attracted an increasing share of total Dutch investment volume in recent years. Since 2018, Brabant’s share of the national funding mix has grown steadily.

According to Gerard Spanbroek, director of the Brabant Startup Fund, this is no coincidence. “In Brabant, we see a growing number of founders building impactful, socially and economically scalable companies,” he says in the report. “Especially in health and deep tech, but we also see strong results in emerging sectors such as plant-based innovation, defence, and AI.” He points to companies such as Salvia BioElectronics, Fiber Foods, ShanX Medtech, Carbyon, and Touchwaves as examples of startups that have successfully scaled after early-stage funding.

Scaling remains the pain point

Still, the overall picture is not exclusively positive. The report shows that the so-called scale ratio (the percentage of startups that actually grow into scale-ups) stands at 23.7% in Brabant. This is comparable to the Dutch average, but lags behind countries such as Germany and falls far short of the United States.

“Scaling remains our biggest challenge,” Braventure concludes bluntly. Many companies are founded, but the step towards international growth and large follow-on funding rounds above €100 million remains rare in Brabant. This even applies to Brainport Eindhoven, where the deep tech ecosystem enjoys strong international recognition.

Four regions, four profiles

The report makes clear that Brabant is not a monolithic ecosystem, but consists of four distinct sub-regions, each with its own dynamics.

Mid-Brabant positions itself as a talent engine, thanks in part to Tilburg University and Fontys. The number of new startups has increased significantly in recent years. While an average of 4 startups per year were founded between 2020 and 2022, this figure has risen to around 10 per year since 2023. Christian van Hulten, business coach at Midpoint Brabant, sees a clear shift: “Since 2023, we have been working more intensively with impact-driven startups and unlocking entrepreneurial potential that previously remained untapped.”

North-East Brabant is dominated by two clusters: Oss, with a strong focus on pharmaceuticals and biotech, and ’s-Hertogenbosch, where AI, SaaS, and food startups set the tone. Around 95 percent of all regional funding flows to companies in or around these two cities. Jonie Oostveen of venture builder Elevate-X stresses the importance of cohesion: “By combining funding, guidance, and a strong regional network, we can truly make a difference for the entrepreneurs of tomorrow.”

West Brabant primarily focuses on applied technology, with growing attention for gaming and plant-based innovation. At the same time, funding here is highly concentrated: three companies (The Protein Brewery, Revyve, and Monkeys by the Sea) account for the majority of investments in the region. What stands out is that West Brabant attracts talent from a wide range of educational institutions, including Avans and Breda University of Applied Sciences, as well as TU Delft and Wageningen University & Research.

South-East Brabant, with Brainport Eindhoven at its core, is by far the strongest region in terms of capital and R&D intensity. Between 2020 and 2025, more than €1.5 billion was invested here, compared to €329 million in the 2015–2020 period. Per capita, Brainport ranks among Europe’s top regions for deep tech funding, particularly in semicon. Even here, however, true mega-scale is still missing.

Overview as a strategic instrument

According to Bulsink, it is precisely this combined picture that constitutes the report's strength. The result is explicitly intended as a conversation starter for policymakers, investors, and ecosystem builders who want to understand where Brabant stands today and where acceleration is still needed.

The conclusion is clear: Brabant has the building blocks, the talent, and the capital, but the next phase demands a stronger focus on scaling. Not in fragmented regional silos, but as a coherent ecosystem that helps startups break through internationally.

All data is brought together in this dashboard. The full report can be downloaded here.