2024 in figures for startups in the Netherlands: rising investments despite decline in Q4

Last year, Dutch startups raised a quarter more in investments than in 2023.

Published on January 15, 2025

As editor-in-chief, Aafke oversees all content and events but loves writing herself. She makes complex topics accessible and tells the stories behind technology.

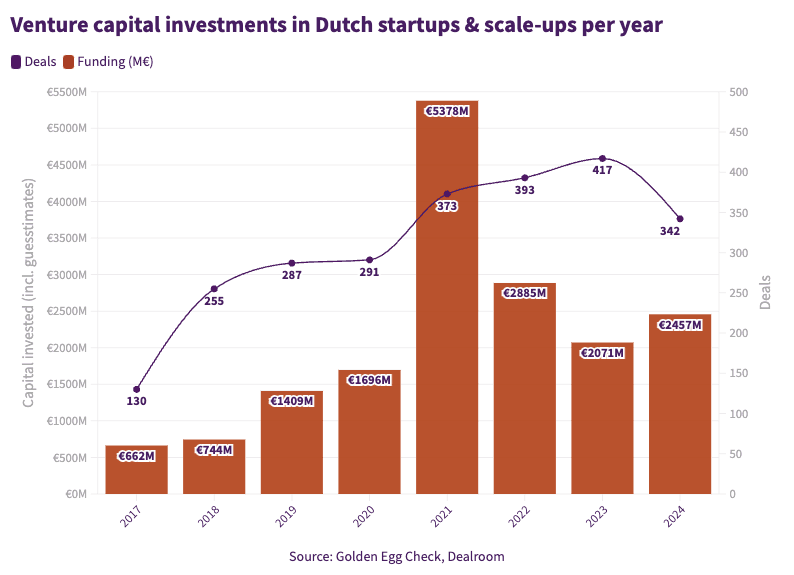

Dutch startups have raised around €2.3 billion in investments in 2024, up 23% from 2023, when €1.9 billion was invested. Based on informed estimates, the actual amount is around €2.5 billion. This makes 2024 the third best year ever, after the record years 2021 (€5.4 billion) and 2022 (€2.9 billion).

According to the latest edition of the Quarterly Startup Report, a quarterly data analysis by Dealroom.co, Golden Egg Check, KPMG, the Regional Development Companies (ROMs), the Dutch Association of Participation Companies (NVP), the Dutch Startup Association (DSA), and Techleap.

Strong year despite weaker fourth quarter

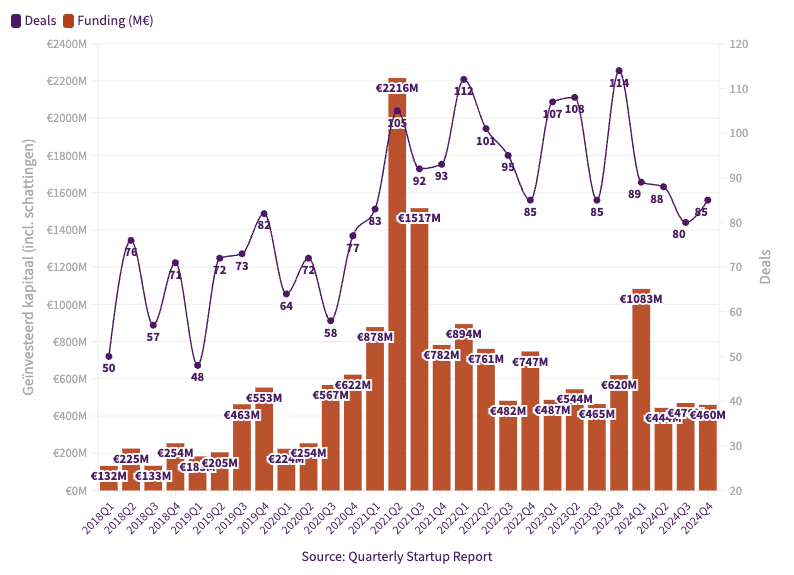

Although 2024 showed substantial numbers overall, Q4 saw a decline. In Q4, €416 million was invested, 28% less than in the same quarter last year (€576 million) and 4% less than in Q3 2024 (€434 million). The deals fell 25% from Q4 2023, from 114 to 85.

There was a slight uptick in pre-seed investments (under €1 million), which accounted for 30% of deals with known amounts in Q4. This is the highest percentage in 2024 but only half the number of pre-seed deals in Q4 2023 (19 versus 43). Q4 was the strongest quarter for Series A investments (€4 to 15 million), but the weakest for Series B+ (€15 million or more). There were no investment rounds of €100 million or more in Q4, while four large rounds happened in the rest of 2024.

Celebrating (Brabant's) success

Something that could also be done better in the Netherlands is celebrating success. DSA organized a New Year's edition in collaboration with IO+ to change that. The startups that secured funding and investors that invested in 2024 met yesterday in Amsterdam (TNW) and Eindhoven (LUMO Labs).

Of the ten most significant investments in 2024, Oss-based Citryll is in fifth place (€85 million), and Eindhoven-based halfling supplier Axelera (€68 million) takes seventh place.

Top 10 biggest investments in 2024

- Picnic – €355 million (Q1)

- Nearfield Instruments – €135 million (Q3)

- Mews – $110 million (Q1)

- DataSnipper – $100 million (Q1)

- Citryll – €85 million (Q4)

- Cradle – $73 million (Q4)

- Axelera AI – $68 million (Q2)

- Vico Therapeutics – $60 million (Q1)

- FINOM – €50 million (Q1)

- Payt – €55 million (Q3)

* amounts invested in original currency.

Increase in new funds in 2024: record amounts raised

In addition to startup investments, 2024 saw strong growth in new venture capital funds. Twenty new VC funds collectively raised about $3 billion, driven by larger fund sizes than in previous years. Key examples include Forbion Ventures Fund VII (€890 million), Innovation Industries Fund III (€200 million), and SET Fund IV (€200 million). The largest fund raised for the first time was Infinity Recycling Circular Plastics Fund I (€175 million). This fundraising level aligns with 2022 and 2023 but is more than double each pre-2022 year.

The outlook for 2025

“€2.3 billion is a lot, and compared to the rest of Europe, we have been hovering in the top 5 for years,” says Lucien Burm of dSa. “But to put this in perspective: in the US, AI startups like Anthropic can raise the same amount or more in one round several times in the same year. For our competitiveness, it is fundamental to start achieving a multiple of the current investments.”

“After a good start in the first quarter, I had expected and hoped that investment growth would pick up after almost two years of relative status quo. Unfortunately, that was not the case,” said Thomas Mensink, CEO of Golden Egg Check. “Many startups are having more trouble attracting follow-on funding; investors often have to step in with additional capital and need more time to raise new funds. So, there are still many challenges. A better exit market in 2025 can ensure that investment also strengthens.”